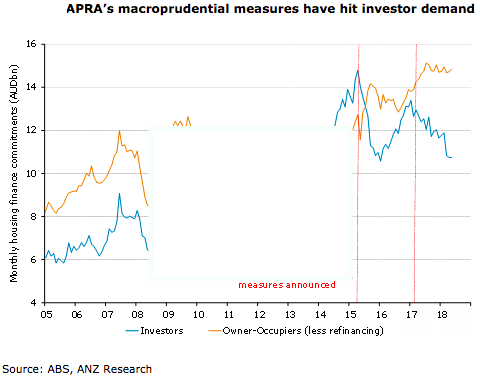

After falling quite heavily in recent months, Australia’s housing finance commitments posted a small rise in May. The investor segment contracted further, continuing the weakness in the wake of APRA’s macro-prudential policy changes.

The value of Australian housing finance commitments rose slightly in May, but not by enough to offset recent weakness. The value of monthly approvals is more than five per cent lower than a year ago. Investors are the main driver of this weakness, edging down another 0.1 percent m/m, while the owner-occupier segment is performing better (0.8 percent m/m).

The fall in investor demand is clearly related to APRA’s macro-prudential policies. In 2015, the 10 percent speed limit on investor borrowing saw a sharp drop in the presence of investors, and the subsequent limit on interest only loans in 2017 has had a similar impact.

Even the removal of the 10 percent growth limit, announced at the end of April 2018, is unlikely to drive renewed strength. As a result, the share of new lending going toward investors is at the lowest level in several years.

"A central feature of our view on the housing market is that credit conditions continue to tighten through the remainder of 2018. This is expected to result in further weakness in housing finance going forward, which will in turn weigh on housing prices and building approvals," ANZ Research commented in its latest report.

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment