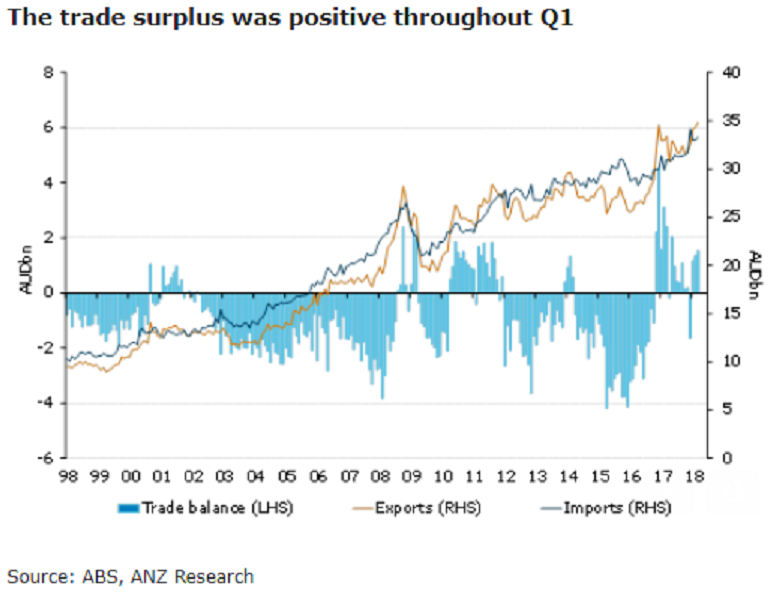

Australia’s trade balance improved in March to a surplus of AUD1,527 million, while February’s surplus was revised higher to AUD1,349 million. Non-monetary gold was the biggest riser for both exports and imports, but in net terms, it was a negative for the trade balance. Both exports and imports rose 1 percent in the month.

The trade balance improved in March to AUD1,527 million. Notable was the large upward revision in February’s surplus to AUD1,349 million (from an initial estimate of AUD825 million). March’s improvement was driven by the rise in total exports slightly outpacing the rise in total imports.

Total export values increased 1.4 percent (AUD488 million) in the month, after increasing 0.7 percent in February. The volatile non-monetary gold segment was the biggest riser, up 7.7 percent m/m. Manufacturing goods also increased solidly, rising 6.5 percent m/m, due to an 8.4 percent increase in machinery and a 6 percent rise in other manufacturing. Rural goods rose 3.3 percent, mainly due to a 44 percent rebound in cereals.

Further, total import values rose 0.9 percent m/m (AUD310 million), after increasing 0.1 percent in February. Non-monetary gold (48.3 percent m/m) saw the biggest increase in imports as well. Fuel imports rose strongly, rising 16.3 percent in the month, reflecting the strength in oil prices. Meanwhile, service imports fell 0.6 percent m/m as transport (-1.5 percent m/m) and travel (-1.2 percent m/m) offset a 0.9 percent rise in other services.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022