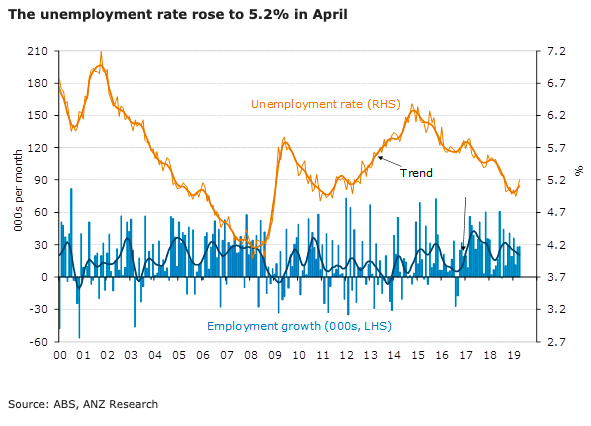

Australia’s unemployment rate moved higher during the month of April despite solid gain in jobs; increased labour supply drove the rise in the unemployment rate, with the participation rate at its highest result on record. The rise could be interpreted as the product of a healthy labour market, according to the latest report from ANZ Research.

Employment increased by 28.4k in April, exceeding the upwardly revised 27.7k in March. In contrast to last month, employment gains in April wholly resulted from a 34.7k rise in part-time jobs. Full-time jobs went backwards by 6.3k, following a strong March figure of 49.2k full-time jobs added.

Year on year, full-time jobs are up 2.9 percent, while part-time employment is up 1.9 percent and total employment accelerated to 2.6 percent.

The unemployment rate was 5.2 percent in April, up 0.3ppt from the low of 4.9 percent in February. The participation rate rose to 65.8 percent, the highest on record (to two decimal places). The underemployment rate jumped from 8.2 percent in March to 8.5 percent in April. So overall slack in the labour market was up quite a bit.

The unemployment rate rose in all states apart from Queensland, which saw a 0.2ppt fall to 5.9 percent. New South Wales (4.5 percent) and Victoria (4.9 percent) maintain the lowest unemployment rates across the states.

"Employment growth is accelerating; moving in the opposite direction from what our ANZ Labour Market Indicator would suggest. However, we see the increased slack in the labour market as a barrier to improving wage growth and inflation," ANZ Research further commented.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns