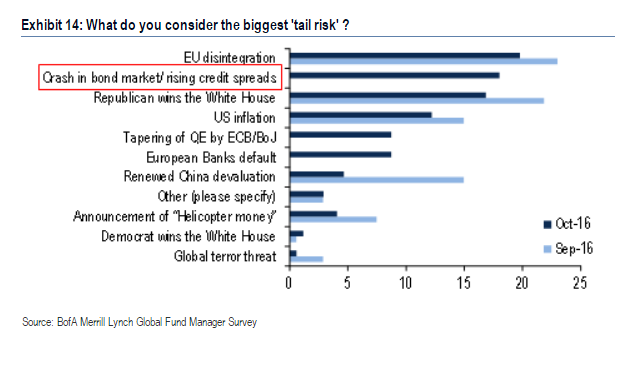

The BofAML global survey involving 171 fund managers, holding $443 billion in assets, showed that the asset managers are wary of following risks.

- According to the fund managers’ survey, EU disintegration is the biggest risk prevailing in the financial markets. However, the perception of the risk is down in October, when compared to September survey.

- A new risk has been added by the fund managers and that is the crash in the bond market or rise in the credit spreads. We at FxWirePro have been warning of this for quite some time now. According to us, lending debt-burdened government at negative rates is riskier than currently assumed. It is now considered as the second biggest risk prevailing, according to the survey.

- In September, the second most considered risk was the win by Donald Trump but that has now subsided to the third position, probably because Hillary is ahead according to polls.

- Inflation in the United States is once more back in the focus. We have been warning on this too. However, despite the perception, the threat of inflation is still low but that we expect won’t be the case for very long. It would also be a key factor in the bond spread as well as tapering, which is the fifth most widely considered risk.

- Interestingly, China’s devaluation that occupied the fourth place in the risk matrix in September has now subsided to the seventh position.

- Defaults in European banks are now sixth most widely considered a risk to the financial markets.

Other tail risks considered by the fund managers are Helicopter money, win by Hillary Clinton and global terror. Interestingly, Geopolitical tensions didn’t make it to the list. However, we at FxWirePro are very worried on that front and feel that similar approach of the Obama administration by the Democrats, if Hillary wins would exacerbate it.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure