Bank of England's monetary policy meet is scheduled for Thursday, 17th March, a day after the new budget is delivered, and the central bank will undoubtedly retain interest rates at current record lows as the UK economic recovery looks to be stalling. The MPC is expected to vote unanimously in favour of leaving rates unchanged.

There have been few signs of life in the hard-pressed UK's manufacturing sector. Data released last week showed that output in UK manufacturing rose 0.7 percent on the month following a 0.3 per cent dip, the first increase for four months and easily topping expectations for a 0.2 per cent uptick. Recent oil and commodities moves may be a relief to the MPC but inflationary pressures elsewhere are lacking (wage growth still facing structural issues).

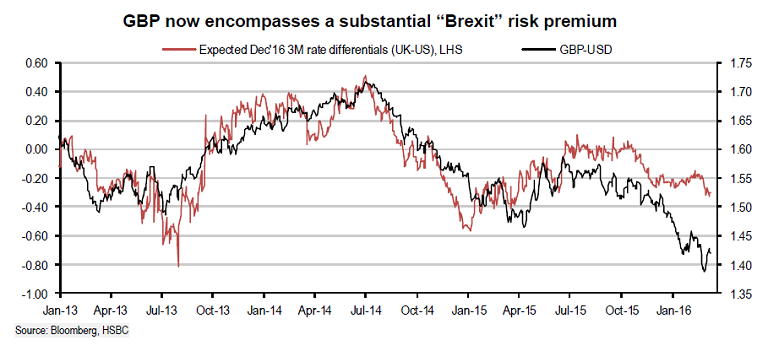

The BoE will take a cautious line ahead of a defining vote on European Union membership. Markets will probably look for hints on whether or when the BoE will stop talking about hiking rates and start talking instead about cutting rates. That said, hard data hasn't deteriorated enough for members to vote for a cut. Economists have pushed their bets on when the BoE will start to raise rates back to early 2017, reflecting a weaker global economy and persistently low inflation.

"We’ll look for the MPC’s assessment of the causes of the recent weak survey data – in particular to see if they express any fears over the impact of the Brexit vote on growth," said TD Securities in a research note.

The meeting is likely to be a non-event meeting and should have relatively little impact on the pound. However, GBP/USD exchange rate could see notable volatility if there are any surprises from commentary from the MPC about Brexit. GBP rally against the USD seen capped at 1.4436 as we head into BoE Thursday. Cable is extending declines for a second consecutive day, trading at 1.4170 at 1015 GMT.

"A more dovish BOE tone this week, especially in light of mounting Brexit worries and the impact that those worries are having on the U.K. economy, could send the pound lower against the greenback," say Commonwealth FX in a currency brief to clients.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist