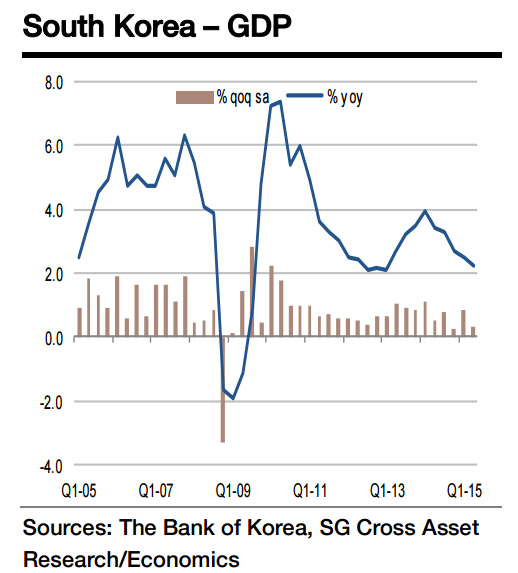

The Bank of Korea (BoK) Governor Lee disclosed a flash estimate of 1.1% qoq for Q3 2015 GDP growth at the recent IMF conference in Lima, which was echoed by President Park. Finance Minister Choi too has emphasized a recent recovery in domestic demand. We got more information on the breakdown of Q3 GDP from BoK's quarterly macroeconomic outlook released on 15 October.

"According to our estimate, based on BoK's detailed GDP forecasts, we are likely to see a sizeable pickup in domestic demand: we anticipate qoq growth of 1.0% for private consumption, and around 2.0% growth in both construction and facility investment", says Societe Generale.

The strength in consumption points to a recovery from the MERS shock; the sustained strength in construction investment comes on the back of a resilient housing market; and the pickup in non-construction investment may be a sign of normalisation after the weakness in H1. The contribution from net exports should be negative as goods exports growth is expected to be around zero after considerable strength in Q2. A significant pickup in GDP driven by consumption and investment would support the BoK's decidedly neutral stance that was obvious at the October MPC meeting.

BoK already flagged a significant pickup in GDP fuelled by domestic demand

Tuesday, October 20, 2015 12:58 AM UTC

Editor's Picks

- Market Data

Most Popular

Bank of Korea Expected to Hold Interest Rates at 2.50% Through 2026 Amid Currency and Housing Market Risks

Bank of Korea Expected to Hold Interest Rates at 2.50% Through 2026 Amid Currency and Housing Market Risks  China Holds Loan Prime Rates Steady as PBOC Maintains Cautious Monetary Policy

China Holds Loan Prime Rates Steady as PBOC Maintains Cautious Monetary Policy  BOJ Governor Ueda Meets PM Takaichi as Markets Eye Possible Rate Hike

BOJ Governor Ueda Meets PM Takaichi as Markets Eye Possible Rate Hike  Christine Lagarde Reportedly Set to Exit ECB Before End of Term

Christine Lagarde Reportedly Set to Exit ECB Before End of Term  RBA Raises Interest Rates to 3.85% as Inflation Pressures Persist

RBA Raises Interest Rates to 3.85% as Inflation Pressures Persist  RBNZ Holds OCR at 2.25% as Inflation Set to Ease Toward 2% Target

RBNZ Holds OCR at 2.25% as Inflation Set to Ease Toward 2% Target  Bain Capital Secures RBI Approval to Acquire Up to 41.7% Stake in Manappuram Finance

Bain Capital Secures RBI Approval to Acquire Up to 41.7% Stake in Manappuram Finance