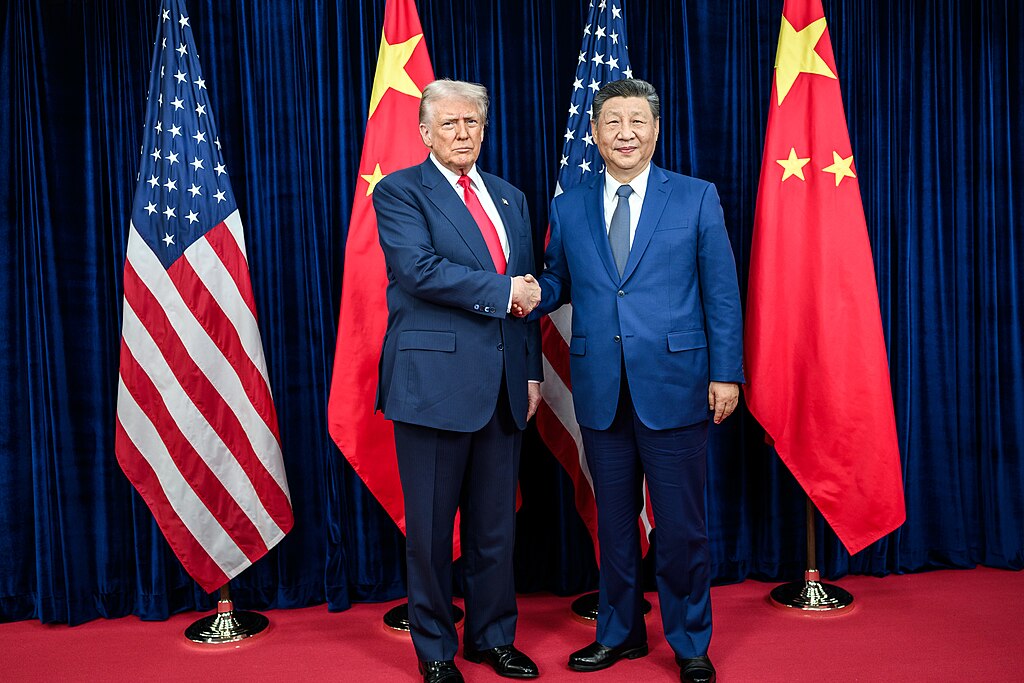

China confirmed it will suspend retaliatory tariffs on select U.S. imports following last week’s meeting between President Donald Trump and Chinese President Xi Jinping. Starting November 10, Beijing will remove duties of up to 15% on certain American agricultural goods but maintain a 10% levy introduced earlier, along with a 13% tariff on U.S. soybeans.

The move signals progress in easing trade tensions between the world’s two largest economies after years of tariff disputes that disrupted global supply chains. Analysts say the decision shows both sides are committed to implementing their recent trade understandings.

U.S. soybean futures surged to their highest level since June 2024 amid hopes for renewed Chinese demand. However, the continued 13% tariff keeps American soybeans less competitive compared to Brazilian supplies. With Brazilian beans priced over $1 cheaper per bushel, traders expect limited Chinese purchases from the United States unless Beijing fully waives the duty.

Despite the tariff, the White House announced China’s intention to buy at least 12 million metric tons of U.S. soybeans by year-end and 25 million tons annually over the next three years. China has yet to confirm these commitments. Analysts suggest state grain buyer Sinograin may handle most purchases, as it operates outside commercial constraints and contributes to national reserves.

Before the leaders’ meeting, state-owned trader COFCO made symbolic U.S. soybean purchases from the 2025 harvest, signaling goodwill. In 2024, the U.S. accounted for just 20% of China’s soybean imports—down from 41% in 2016.

China’s cabinet also announced a one-year suspension of an additional 24% tariff on certain U.S. goods and the temporary removal of non-tariff measures imposed earlier this year. The decision highlights cautious optimism for improved U.S.-China trade relations while global markets await concrete signs of large-scale agricultural purchases.

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks

US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions

Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges

Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges  Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding

Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength