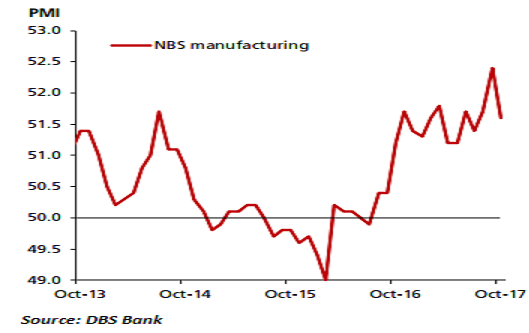

China’s Official manufacturing purchasing managers’ index (PMI) fell to 51.6 in October from 52.4 in September. It was, however, still at the average level for January-September. New orders dropped to 52.9 from 54.8, while production edged lower to 53.4 from 54.7.

The moderation, in part, was the result of week-long holidays and a slowdown in industries cutting production to reduce air pollution ahead of the Party Congress. Meanwhile, it could also be attributed to regulators’ drive to rein in financial risks. Last month, short-term corporate loans contracted by RMB52 billion, the first decline since October 2016. Entrusted loans also registered a 47 percent fall on a yearly basis.

Looking ahead, tightening credit and rising borrowing costs will continue to weigh on activities. Adding to the pressure is the anti-pollution campaign. According to the Ministry of Environmental Protection, new measures will be introduced in Beijing, Tianjin, Hebei, Henan, Shanxi, and Shandong to tackle winter air pollution. That will likely result in production disruptions.

Fears of winter shortages will keep commodity prices at relatively high levels. Elevated PPI, in turn, lowers real interest rates and boosts industrial profits. This, together with the uptick in CPI inflation in Q3, suggesting that the People's Bank of China will maintain its prudent and neutral monetary policy stance.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off