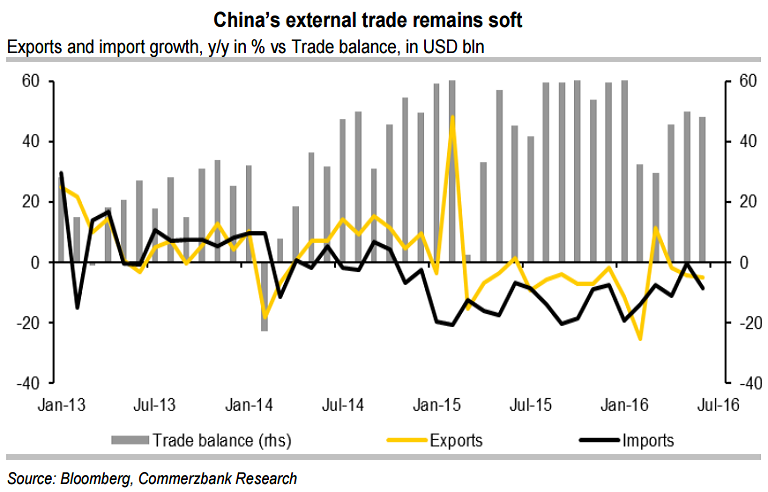

According to the data released earlier today, Chinese trade balance for the month of June fell to 311 billion, down from May’s surplus of 325 billion. The data was lower than the consensus estimate of 320 billion.

China's trade surplus shrank in June despite exports surprising to the upside on an annualised basis and imports dropping less than expected last month. Data showed China's June exports rose +1.3% Y/Y beating expectations for a fall of -4.5% Y/Y, June imports fell -2.3% Y/Y compared to median forecasts for a -4.2% Y/Y fall.

CNY weakened by 6.5% against the currency basket so far this year. However, there has been little improvement in China’s exports so far. Today’s trade data clearly suggest a fast CNY depreciation will have very limited impact on boosting exports. This could well be why Chinese authorities have allowed the yuan to drift lower in recent weeks. The inability to boost exports is likely to increase the pressure on the yuan in the short term, which in turn could well see it decline further towards 6.80 against the US dollar.

"Today's trade data will have little impact on the PBoC’s exchange rate policy. The authority is more willing to allow the RMB to dictate by market forces. In addition, the government has reiterated an industrial policy to promote innovation and technological advancements instead of relying on cheap labour. We do not expect China to boost exports through competitive devaluation," said ANZ in a report.

China’s domestic economy is not growing fast enough for domestic consumption of imports to rise by more than the foreign consumption of Chinese goods. China’s manufacturing regime is going strong (more or less), revealing that the nation continues to generate a large percentage of the goods that the world consumes. The economy has not, in fact, restructured sufficiently toward a consumption-based economy, even though domestic consumption is slowly rising. This suggests that as commodity prices rise again, Chinese export growth will expand. USD/CNY was up 0.01% on the day at 6.6880 at around 1115 GMT.

"June trade data suggest that the overall external demand remains soft, which is reflected in Taiwan and Korea’s trade numbers as well. That said, China’s Q2 GDP growth is likely to moderate further. We think that China’s economy will grow 6.6% y/y in Q2, from 6.7% in Q1," said Commerzbank in a report.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility