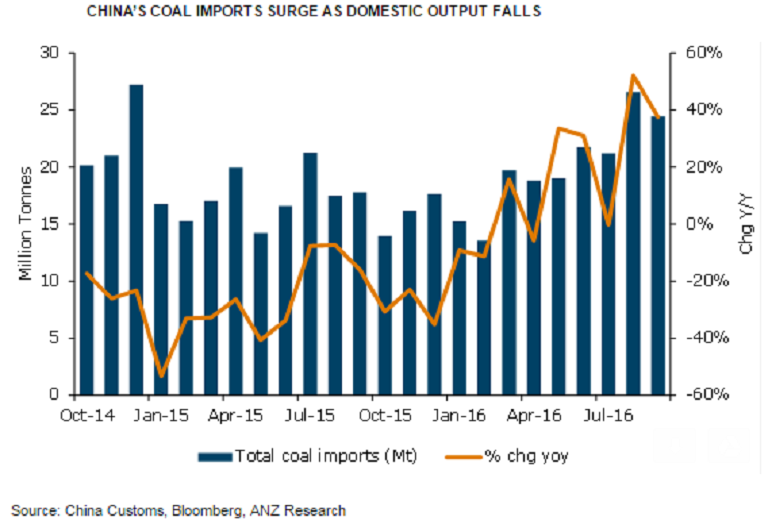

Coal imports in China are expected to remain strong in the near term, despite efforts to limit the impact of capacity closures on utilities, while prices are likely to be dictated by the country’s policy measures.

Thermal coal prices hit USD100/ton this week as exporters struggled to react to the shifting dynamics in the seaborne market. Led by China’s sudden reliance on the international market, import demand in the Asian sub-continent has surged higher in recent months.

Stocks held on major exchanges have fallen across the board in September. The main reason behind the falls has been falling supply around the world, rather than a pickup in demand. Zinc stocks suffered the biggest fall (-7 percent m/m), while copper was the only metal to register an increase (+2 percent). Even then, it seems base metal markets are tightening.

"If coal output can be temporarily raised leading into the northern hemisphere winter, we could see prices slip over the next couple of months. Even so, we expect spot prices to remain above USD80/t over the northern hemisphere winter," ANZ commented in its latest research note.

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility