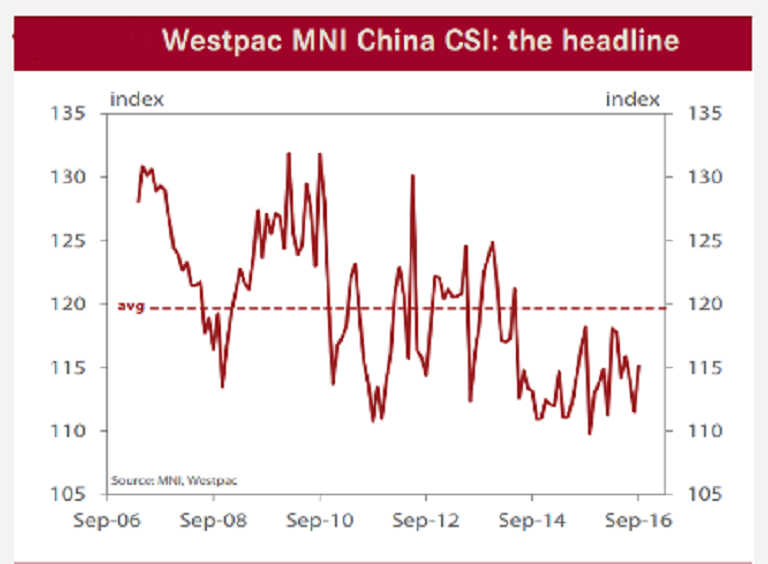

China’s consumer sentiment recovered during the month of September, although remaining well below the long-run average of 120, but is slightly above the average read over the last 12 months.

The Westpac MNI China Consumer Sentiment Indicator recovered in September, rising 3.3 percent to 115.2 from 111.5 in August. All five components improved in September. Consumers’ near-term expectations recorded the strongest gains: ‘family finances next 12 months up 7.1 percent and ‘business conditions, next 12mths’ up 4.9 percent.

Further, assessments of ‘business conditions, next 5 years’ recorded a milder 2.6 percent rise with views on ‘family finances vs a year ago’ up 1.3 percent and assessments of ‘time to buy a major item’ up just 0.7 percent. Notably, all components remain materially below their long-run averages.

Chinese consumers also marked up their assessment of current business conditions: the ‘business conditions vs a year ago’ index up 4.6 percent and basically in line with long-run average. Job security recorded a particularly strong rebound, the employment indicator surging 8.0 percent more than reversing last month’s 7.4 percent drop.

Meanwhile, this month’s rebound in confidence is clearly a welcome development, particularly after the sharp slide in June-August. However, even with a recovery, sentiment is still at a low level overall and yet to establish a convincing recovery.

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022