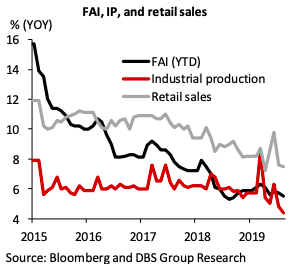

China’s economy slowed further in August, with industrial production growing at the weakest pace in more than 17 years; Industrial production rose 4.4 percent y/y in August, the lowest since 2002 and slower than the 4.8 percent growth in July, DBS Group Research reported.

Fixed asset investment rose 5.5 percent YTD, down from 5.7 percent previous month. Infrastructure investment accelerated but was not sufficient to offset the slowdown in private investment. Retail sales growth slowed to 7.5 percent, compared with 7.6 percent in July. Auto sales fell 8.1 percent after declining 2.6 percent previous month.

Leading indicators showed mixed signals. Caixin manufacturing PMI increased to 50.4 in August from 49.9 previous month. But trends on the supply and demand side diverged, with rising output but falling new orders. Notably, new export orders slid deeper into contractionary territory.

Demand for credit was lacklustre amid rising uncertainty. Growth in total social financing remained flat at 10.7 percent in August, while loan growth retreated by 0.2pp to 12.4 percent. The impact of targeted policy easing has so far been limited.

Since early 2018, PBoC has injected more than RMB3.6 trillion in net liquidity through seven reserve cuts. However, financing costs for the real economy has failed to decline. The weighted average lending rates have remained broadly unchanged in the past three quarters (5.66 percent for Q2 2019; 5.69 percent for Q1 2019; 5.64 percent for Q4 2018). M2 stayed historically low, albeit edging up 0.1pp to 8.2 percent in August.

"We expect Beijing to strive to put a floor under the economy. A rate above 6 percent in 2019 and 2020 would be needed to double 2010 GDP by next year. We expect PBoC to lower RRR by another 50-100bps in Q4. Property, however, will unlikely be used as a short-term means of stimulating the economy given the still-elevated home prices," the report further commented.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off