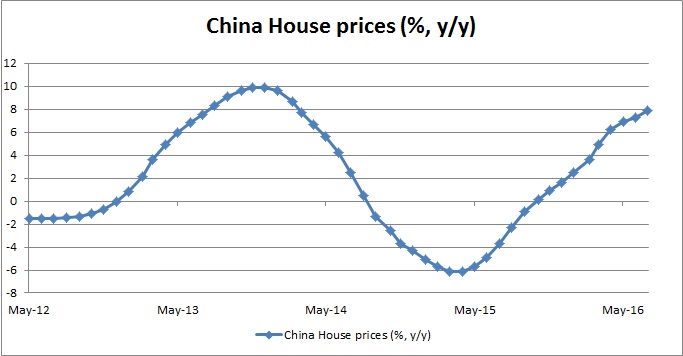

According to the data from China’s National Bureau of Statistics (NBS), the prices for new residential homes rose by 7.9 percent in July from a year back. Prices rose in 58 out of 70 cities surveyed on a yearly basis and declined in 11 of them. In June prices rose in 57 cities on a yearly basis. So there have been improvements. On a monthly basis, prices rose in 51 cities and declined in 16 of them. Overall growth is up from 7.3 percent registered in June.

However, the growth wasn’t broad-based. It is driven by first and second tier cities. Shenzhen topped the list again with 41 percent y/y growth, followed by Nanjing (34 percent), Xiamen (33.9 percent), Hefei (33 percent), Shanghai (27.3 percent), and Beijing (20.3 percent). This spectacular yearly statistics, however, hides monthly slowdown. Prices growth slowed down markedly in the majority of the cities.

Data released last week showed that the sales and investment in real estate have started to a slowdown. Real estate sales totaled Rmb5.7 trillion ($857.9 billion) during the January-July period, a deceleration of 2.3 percentage points for year-to-date growth from a month earlier to 39.8 percent. Annualized growth in real estate investment YTD came in at 5.3 percent in July, down from a peak of 7.2 percent in April.

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed