China’s producer price index (PPI) is expected to witness further upside movement on a y/y basis, based on the recovery of domestic construction activities. Steel prices have rebounded in April, as the Lunar New Year holiday effect faded and construction activities have recovered from late March.

The steel price index (composed by the China Iron and Steel Association) has returned to 112.8 at the end of April from 108.7 from end-March. Rebar inventories have also declined from 179.7 mt to 141.5 mt in April, suggesting a more balanced demand-supply situation. The rise in oil prices should also lead to higher prices of chemicals.

Today’s inflation data should have only marginal influence on the rates market. After a quick rally in April following the PBoC’s reduction of the required reserve ratio, the market’s short-term focus is now on the liquidity conditions in the money market. Over the longer term, investors will be focusing on US-China trade tensions, USD rates, and overall economic growth.

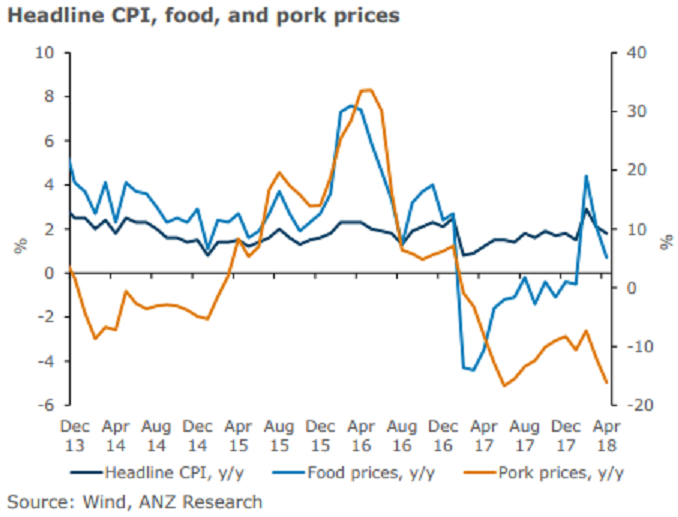

In addition, pork prices (-16.1 percent y/y) were the key drag on overall food prices and headline CPI in April. The impact of falling pork prices on headline CPI was 0.43 ppt. As such, pork prices have been declining since February 2017 on a y/y basis, although this influence should moderate in the coming months due to a lower base.

"We are vigilant to the rise in oil prices, which will exert upward pressure on the CPI, which has a good correlation (0.55) with domestic oil prices, according to our estimates," the report added.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election