The Chinese economy is expected to advance 6.3 percent during the first quarter of this year, down from 6.4 percent in the last quarter of 2018, with some early signs of a stabilization, according to the latest report from DBS Group Research.

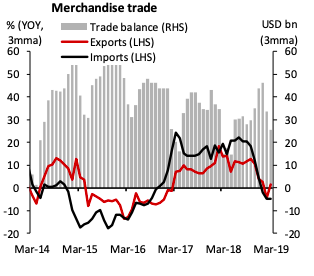

China’s export performance improved markedly. Growth rebounded to 14.2 percent y/y in March from -4.6 percent in January-February and led 1Q19 growth to 1.4 percent. An improvement in sentiment banking on hopes for an easing in trade tensions was also evident in other indicators.

Within the NBS Manufacturing PMI, new export orders rebounded from 45.2 in February to 47.1 in March after 10 straight months of declines. The appreciable export rebound was, however, due to the hefty 66.3 percent contribution in export price to headline growth in 1Q19 and the earlier Lunar New Year this year.

Weakening global demand will continue to hamper the recovery in external trade. Export to the US dropped 9.0 percent y/y in 1Q19 from higher tariffs and recession fears. Between February and March, PMIs fell to 56.0 from 59.1 in the US, 51.6 from 51.9 in the Eurozone and to 50.4 from 50.7 in Japan, the report added.

With global growth risks synchronized to the downside, the IMF has downgraded its forecast for this year’s world growth from 3.5 percent to 3.3 percent, the slowest since 2016. A relatively strong CNY exchange rate also compromises competitiveness of exporters.

Unlike exports, imports growth did not turn positive and contracted 4.8 percent y/y in 1Q19. Despite a modest recovery in oil prices, the decline in imports deteriorated to -7.6 percent in March from -3.2 percent in January-February. WTI crude oil prices have, in the past 4.5 months, recouped 62 percent of the sharp losses incurred in 4Q18, but prices are still below the USD65-75/barrel range seen in 2Q-3Q18, DBS further noted in the report.

Image Courtesy: DBS Group Research

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX