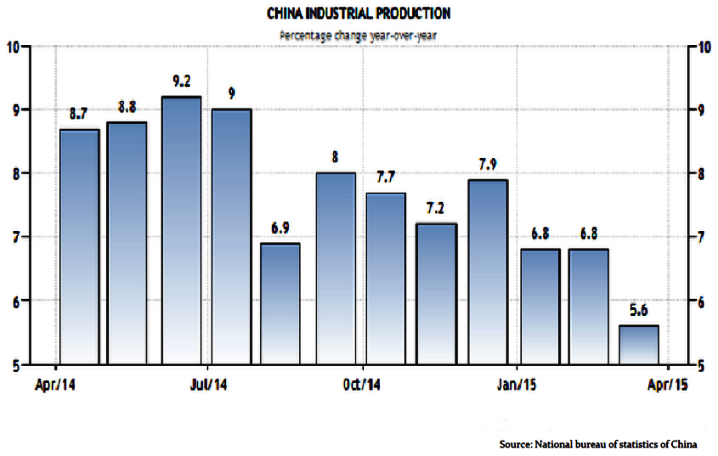

Manufacturing production and revenues are most likely remained under pressure given sluggish domestic demand and the ongoing slowdown in total investment growth. Continued deflation is pretty much to have increased manufacturers' funding costs, as a result eroded their income margins.

As China is all set to announce the official manufacturing PMI for April on 1 May. We look ahead for a moderated to 50.0 from 50.1 in March and the number reflecting still weak underlying momentum in the manufacturing sector.

Currently, the USDCNY spot exchange rate is 6.2004 while the USDCNY spot exchange rate is quoted and exchanged in the same day. The USDCNY forward rate is quoted today but for delivery and payment on a specific future date. In the offshore market CNY can now be traded as either a fully deliverable offshore currency, or through USD settled NDFs.

Chinese industrial production under stress, hopes of improvements in H2 2015

Thursday, April 30, 2015 7:24 AM UTC

Editor's Picks

- Market Data

Most Popular

4

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings