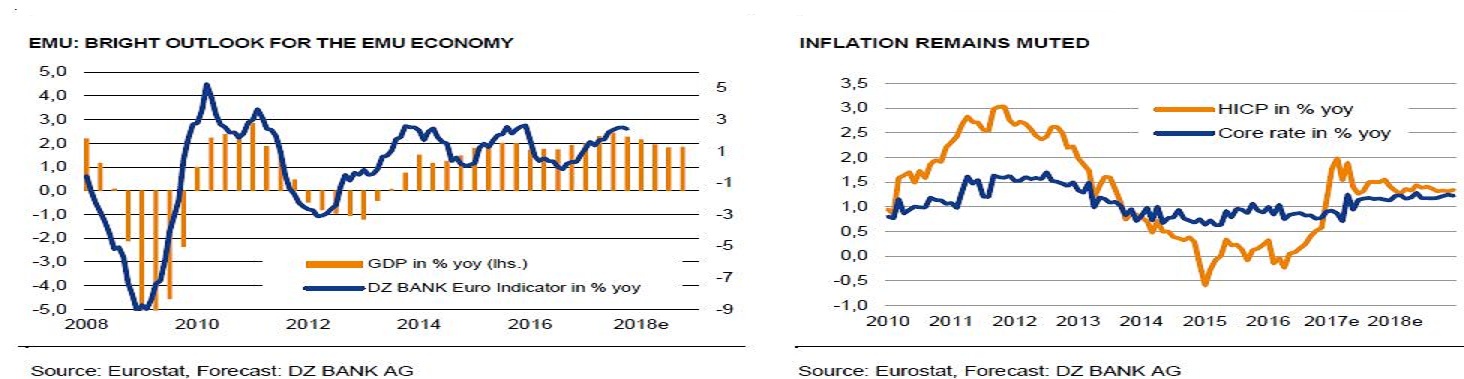

The Eurozone economy is expected to expand 2.3 percent this year and 2 percent in the next year, according to a recent report by DZ Bank. According to a flash estimate from Eurostat, third-quarter GDP increased by +0.6 percent versus the previous quarter. Growth in economic output was also revised up slightly for the second quarter from +0.6 to +0.7 percent.

Compared to the third quarter of 2016, production output even increased by +2.5 percent. Despite the fact that, as is usual with the preliminary flash estimate, no details have been provided yet of the individual demand components of GDP, the economic performance of the Euro area remains broad-based. For initial results from the member countries, which have also released provisional growth figures, are also positive.

The strong economic growth within the single currency area is not only reflected in the quarterly growth figures. Other important economic indicators are also showing the effects of increasing economic output. In September, the average unemployment rate in the EMU declined from 9.0 to 8.9 percent. This was the first time it had fallen below 9 percent since January 2009. In the same month last year, the figure was still 9.9 percent.

The number of people out of work has fallen by more than 1.4 million in the last twelve months. General government debt has also contracted relative to GDP. In the second quarter of 2017, the debt ratio was 89.1 percent. Within a year it has therefore fallen by -1.7 percentage points. The same applies to the average public sector deficit in the Euro area which has shrunk by 0.3 percentage points to 1.2 percent. Inflation is still failing to keep pace with the positive economic conditions.

Prices of unprocessed foods have increased sharply compared to the previous year. The rate of price increase was even higher than in September. However, this was balanced out by slower momentum for energy prices. The growth rate in consumer prices for industrial goods excluding energy, and for services, was also below-average.

"Overall, the inflation trend remains only moderate despite the positive economic climate. This has prompted us to revise our inflation forecast for the EMU. Consumer prices are likely to increase by only +1.5 percent in 2017 compared to the previous forecast of +1.6 percent, and the average inflation rate in 2018 should now be in the region of +1.2 percent," the report said.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom