After highlighting bearish sentiments in our technical write up in our recent post, we have listed out a few fundamental driving forces in this section that leads AUDUSD further downside risks.

Before proceeding further into the core area of this write-up, for more readings on technical analysis, refer below weblink:

Contemplating above technical factors, fundamentally, the bearish scenarios of AUDUSD are foreseen below 0.7150 given:

1) The unemployment rate moves back towards 5.75%, raising risks that the RBA responds to a weakening labour market;

2) The Fed responds to firm labour market outcomes and above-trend growth by delivering a faster pace of hikes than currently expected;

3) China data weaken materially; or

4) The risk markets retrace and vol rises.

Potential trigger events: CoreLogic House Prices (Jun): 2 July, RBA (Jul): 3 July.

We forecast AUD to decline to USD 0.72 by 3Q’18. Both monetary policy divergence and minimal support from commodity prices are expected to push the currency lower over time.

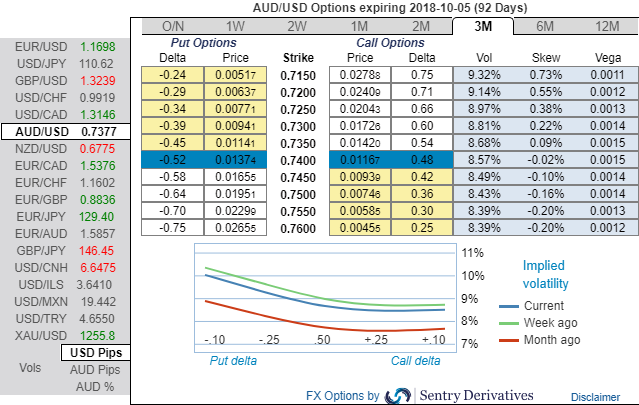

OTC outlook:

Please be noted that the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes upto 0.7150 levels (above nutshell). While bearish neutral delta risk reversal indicates that the hedging activities for the downside risks remain intact.

Accordingly, put ratio back spreads a couple of days ago were advocated, wherein short leg is functioning as the underlying spot FX keeps spiking, we would like to uphold the same strategy on hedging grounds.

Both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price rallies and bidding theta shorts in short run and 3m risks reversals to optimally utilize Vega longs.

On hedging grounds, fresh Vega longs for long-term hedging, more number of longs comprising of ATM instruments and OTM shorts in medium term would optimize the strategy.

So, the execution of hedging positions goes this way:

Initiate longs in 1 lot of vega long in 1m ATM put options and 1 lot of 1m (1%) OTM -0.31 delta put options. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

The Vega is at its maximum when the option is ATM and declines exponentially as the option moves ITM or OTM. This is because a small change in IV will make no difference on the likelihood of an option far out-of-the-money expiring ITM or on the likelihood of an option far into-the-money not expiring ITM. ATM options are far more sensitive since higher IV greatly increases their chances of expiring ITM.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -118 levels (which is bearish), while hourly USD spot index was at -91 (bearish) while articulating (at 07:01 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025