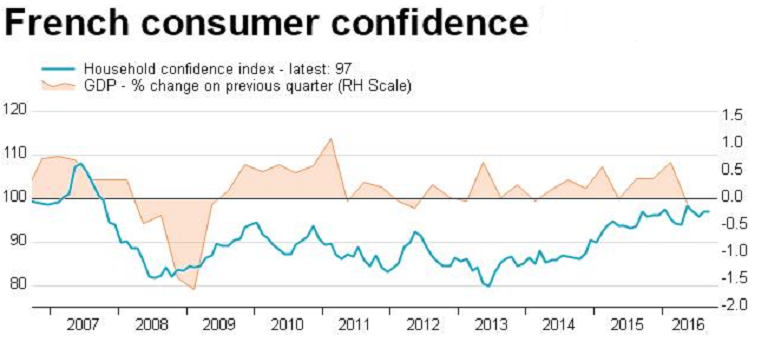

Consumer confidence in France remained stable during the month of September, remaining at par with what markets had initially anticipated.

French consumer confidence index held steady at 97. The score remained below its long-term average of 100, data released by statistics agency INSEE showed Wednesday. Households' opinion of their personal financial situation in the past twelve months was virtually stable. The corresponding index came in at -23 versus -22 in August.

Moreover, consumers' assessment of future financial situation remained unchanged. The index score was -10 in September. Similarly, their opinion on their current saving capacity held steady in September. The index stood at 10. At the same time, the index for future saving capacity rose to -7 from -10.

Households' opinion of the future standard of living in France has picked up in September. The index improved to -31 from -34. On the other hand, the indicator for past standard of living dropped to -55 from -53.

Further, households' fears concerning unemployment have receded a little in September. The corresponding indicator came in at 30 compared to 33 in the prior month. Consumers were more numerous than in August to consider that prices increased during the past twelve months. The corresponding balance gained 5 points to -47, the highest level since December 2014.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX