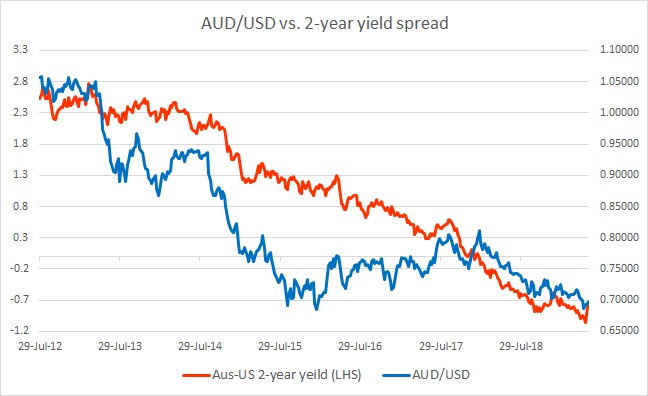

The chart above shows, how the relationship between AUD/USD and 2-year yield divergence has unfolded since 2012.

The chart above makes a clear case of closeness between the rate spread and the exchange rate. The spread between the 2-year U.S. Treasuries and the 2-year Australian government bond declined from +253 bps to -72 bps. AUD/USD responded by declining from 1.056 area to 0.729 area.

In November, we noted that the spread has reversed course and the declining Australian dollar is reducing the divergence fast and if the spread continues its reversal, at one point Aussie is likely to find support in it. The divergence got further reduced in December.

However, the reversal didn’t last long, as the Reserve Bank of Australia (RBA) added dovish comments. Since the comments, the spread has again changed course and widened from just 58 bps in December to -75 bps as of February.

While the Australian dollar ticked higher the spread further widened from -75 bps in February to -84 bps in April, in favor of the USD.

In May, the Reserve Bank of Australia (RBA) reduced rates by 25 bps, which has accelerated the yield decline in Australian 2-year government bond in anticipation of more cuts. The U.S. yields have moved lower too in anticipation of rate cuts by the U.S. Federal Reserve, which in turn narrowed the spread.

In May, the spread has narrowed to -79 bps, and Aussie s consolidating around 0.697 area.

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom