In our recent post, we shed light on lower FX vols, where stated FX vols have been perplexingly soft over the past two weeks in the face of escalating trade war rhetoric and equity markets’ jitters have been the talking point de jour in FX option circles. While it was also stated ATM implied volatilities of G10 FX universe which are at its least, almost across all the tenors, IVs have been shrinking amid trade clashes between the US and China.

In this write-up, we emphasize on why inertness in FX vols that we have encountered are largely unsatisfying; we list some of them and a couple of our own below:

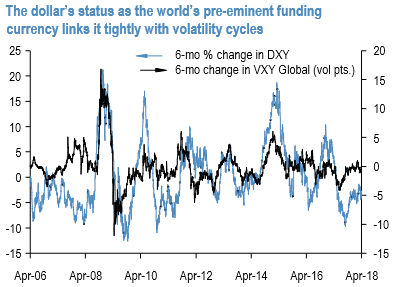

The simple stand perhaps the most compelling is the direction of the dollar. The dollar’s status as the world’s pre-eminent funding currency that seeks out high return international investments during economic expansions and retreats home in crises has led to a tight correlation between USD and FX volatility cycles over the past two decades (refer above chart).

It seems challenging for the universe of dollar-funded balance sheets to absolutely unwound, so goes the argument, as long as a weaker US currency remains a key component of the Trump administration’s efforts to reconfigure the global trade/FX architecture and investors concurrently anticipate widening twin deficits to lead to further dollar slippage. Even so-called fragile EMs like Turkey with wide current account deficits that require financing can get a stay of execution from stock market weakness in this climate as long as portfolio flows are inward bound, not the reverse.

Since the dollar has been largely range-bound for the past two months and has actually bounced 2% from its late March lows, the weak dollar rationale does not strictly explain the very recent past. A second explanation, this one behavioral, is that two months of placidity in the weak dollar trend is testing the resolve of investors to remain in the two major short USD trades of the year-long Euro and long Yen –both of which now incur substantial negative carry on points.

By extension, high theta on option-based expressions. The first step in investor risk forbearance is to avoid buying i.e. a drying up of the USD put demand of January. The second is de-risking which involves active option liquidation; subjective accounts suggest that this has so far happened at the edges, and more could be in store particularly in the yen which IMM positions data shows has been almost entirely short-covered since the turn of the year. The investor performance context is important too: global macro hedge funds with a +5% P/L kitty by end-January (basis HFR Macro/CTA index) had pain thresholds to withstand some volatility around core views that have been revised significantly lower with YTD P/L of-2%.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary