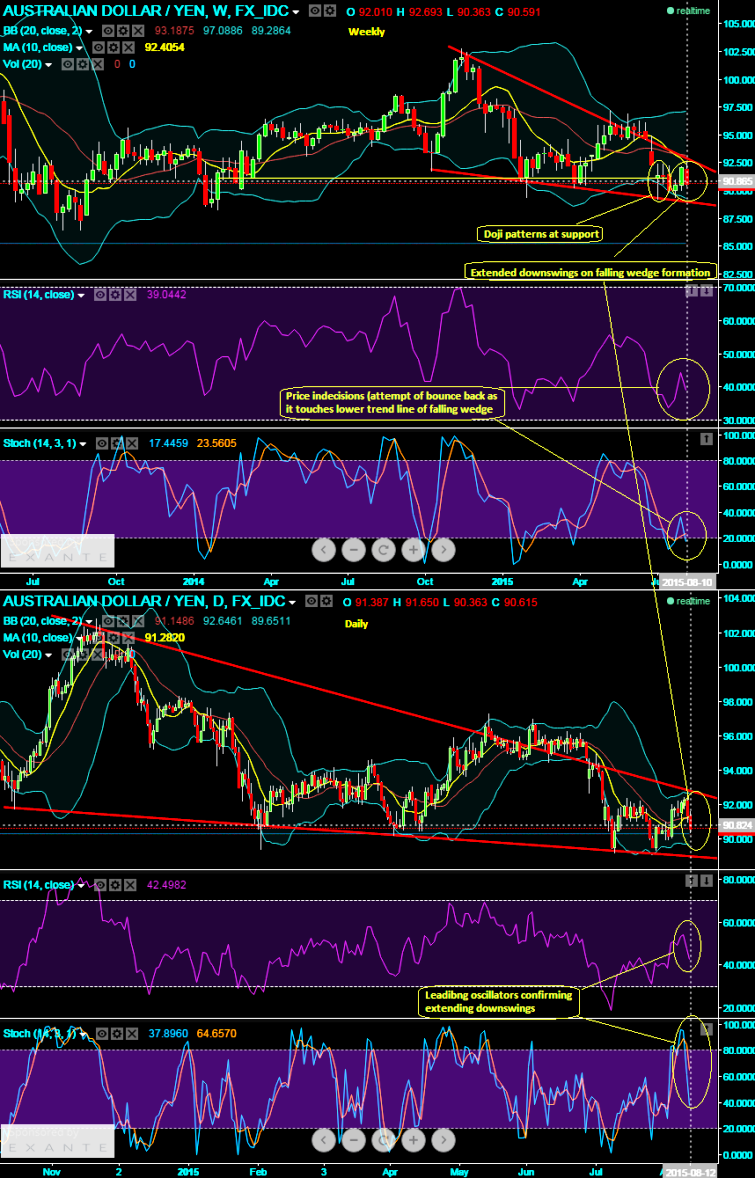

To precisely stating, it is going to be downtrend until it touches 89.347 levels which is at the lower trendline of falling wedge. More précising stating expect downswings in short term trend, bounce back likely in medium term but needs to be confirmed with other indicators.

Both EOD and weekly graphs suggest bearish signals on extended swings in falling wedge formation, Doji patterns formed when the pair was testing a crucial support at around 90.555 levels on weekly charts which means the indication of weakness at that level was intesified.

Leading oscillators like RSI and slow stochastic curves converging downwards according to the price dips on daily charts which is an indication of short term drops on the cards, since it has breached above supports we believe the breach of this level has set the downward direction of next short term trend.

RSI and stochastic on weekly signifies price indecision with daily price fluctuations, so we reckon the short term downtrend which is on falling wedge is temporary until it approaches lower trendline, then at that point of time on subsidiary technical confirmation trend reversal can be adjudged.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings