We expect AUDUSD to decline through 2017 on skinnier rate differentials and a pull-back in commodity prices.

The Dec-17 target is 0.68, 10% below forwards. The combination of a more high conviction Fed cycle in 2017 and further RBA easing should see policy rate cross-over occur for the first time since the late 1990s.

This will leave minimal carry support for AUD, which is particularly important given its vulnerability to a turn in China’s momentum or adverse developments in global trade.

Bearish: AUD/USD below 0.73 if:

1) The labor market weakens forcing the RBA to respond more aggressively to weak inflation;

2) The Fed responds to animal spirits and bullish survey data by delivering a faster pace of hikes than currently expected;

3) Trade tensions and capital outflows force genuine CNY devaluation.

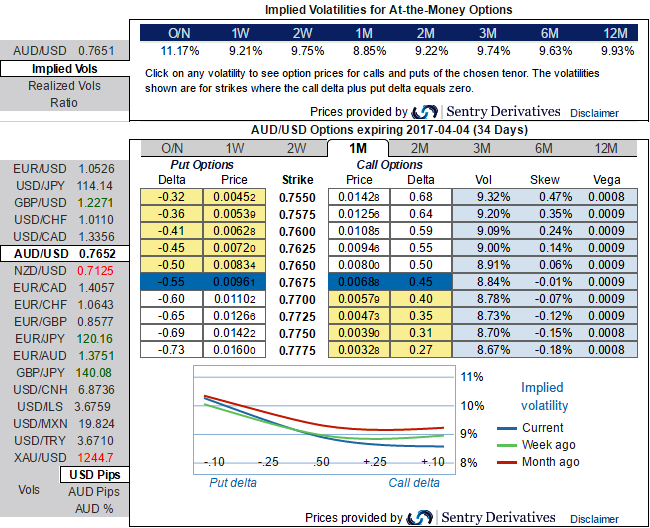

Accordingly, OTC hedging indications from the diagrams evidencing risk reversals and IV skews are in tandem with the above mentioned forecasts and its rationale.

Please be informed that the nutshell showing risk reversals are bids for the hedging for the downside risks, as a result, puts are on more demands over calls. The negative risk reversals across all tenors are indicating the bearish hedging interests.

Let’s also glance on sensitivity tool for 1-3m IV skews would signify the interests of OTM put strikes that would imply hedging sentiments are for downside risks in the underlying spot FX.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom