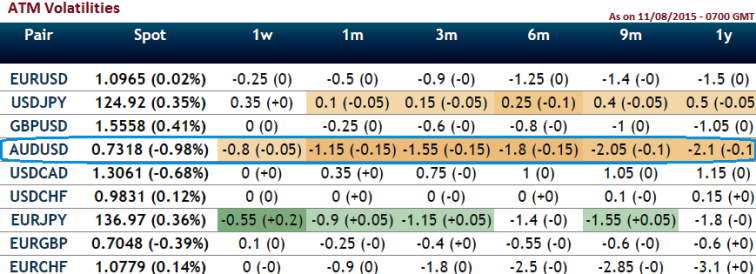

Delta risk reversals of AUDUSD: After the brief upswings to 0.7440, the OTC options market appeared to be more balanced on the direction for the pair over the 1m to 1y time horizon as hedgers have been cautious on long term downtrend that has lasted since mid April 2013 and as a result delta risk reversal for AUDUSD was turning into negative.

From the nutshell, 25-delta risk of reversals of AUDUSD the most expensive pair to be hedged for downside risks as it indicates puts have been over priced. As it showed the highest negative values indicate puts are more expensive than calls (downside protection is relatively more expensive).

Technicals: On weekly charts stochastic curves remained below 20 levels yet it is attempting for %D line crossover which is a signals of current downtrend continuation, while to boost up this the bearish view prevailing prices are trading below moving average curve comfortably.

Hedging Framework:

Fundamental rationale: AUD/USD has been in supply when the PBoC came out and instigated what had been expected of them in as much of the poor performances of the economy of late. Australia's NAB business confidence is published with the business confidence for July coming at 4 versus 8.

As the risk appetite varies from different investors to different traders, we've customized our formulation of strategies for such varied circumstances. Prevailing implied volatility rates for AUD/USD is almost close to 12%. Thus, on a long term hedging perspective, debit gamma put spreads are advocated so as to reduce the sensitivity and focus on hedging motive.

Selling 2W out of the money put option is recommended to reduce the cost of hedging by financing long position in buying 2M in the money Puts as the selling indications are piling up on weekly graph. So, buy 2M (1%) in the money 0.11 gamma put option and short 15D (-1%) out of the money put option for net debit.

FxWirePro: AUD/USD delta risk reversal still signifies bearish trend to resume - Strategic hedging framework with gamma calendar spreads

Tuesday, August 11, 2015 8:28 AM UTC

Editor's Picks

- Market Data

Most Popular

4

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand