Turkey's current-account deficit widened to $4.53bn in September, worse than consensus expectations. On a seasonally-adjusted basis, September saw nearly a doubling of the gap to $6.1bn from $3.2bn in August, with the rolling 4-quarter deficit as the percentage of GDP reaching 5.8%.

There were mild one-off factors relating to holidays in September, which were not entirely removed by seasonal adjustment – nevertheless, Turkey’s trade and current-account balances have been deteriorating in recent months because import prices, in particular, crude oil prices, have been surging.

A wider current-account deficit is lira negative in itself, but in this case also doubly so because higher import prices will impact the inflation outlook.

We see further upside in USDTRY from here, which will ultimately likely force CBT's hand in the form of a rate hike.

FX options trade:

In outright trades, we recommend buying a 2m 4.10 USDTRY call.

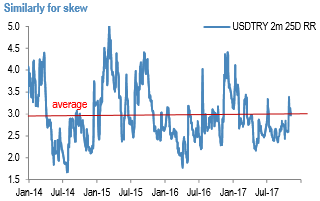

The options market has so far priced in only a moderate deterioration in the outlook for lira with close to average levels of implied volatility and skew (refer above diagrams).

However, as we are in our view now transitioning towards our “bear case” scenario of an increasingly negative feedback loop between the currency, asset prices, and outflows, we can envisage a much more fragile pattern before the central bank is forced to step-in in a credible manner.

The situation is likely to be exacerbated by negative current account seasonality in December and low liquidity around the year-end.

We, therefore, recommend buying a 2m USDTRY 4.10 call indicatively priced at 1.26% (spot ref. 3.8909) to take advantage of the likely rise in volatility and skew as USDTRY trades higher. The risk on the trade is limited to the premium paid.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand