The BoJ governor Kuroda hinted at a delay of timing to reach 2% inflation beyond the end of his term in April 2018.

With growth remaining above trend, the BoJ likely would maintain status quo at its November 1 policy meeting. In this week’s Diet testimony, Governor Kuroda said that global outlook is improving, and it is difficult to think that an immediate change in policy is necessary.

A glance at USD-JPY illustrates who may benefit from a Fed rate hike: the Bank of Japan (BoJ). The former Minister of Economic Affairs Heizo Takenaka summarized it very well: the next chance arises for the BoJ when the Fed hikes interest rates, it would then be able to lower interest rates further thus weakening the yen. In his view, the BoJ is waiting for this opportunity. The idea cannot be dismissed entirely. And fortunately, the BoJ December meeting takes place a week after the Fed’s. At least the yen is under pressure already - a fact the BoJ is certainly pleased about.

Within G10, yen-crosses still look the most likely sources of short vol yield. We had sold some EURJPY gamma after the September BoJ in anticipation of some post-event risk premium normalization, but selling nondelta-hedged strangles would have been a more effective strategy in retrospect as the spot has chopped around within a resolutely sideways 112-116 range.

We’ve already advocated the suitable strategy taking advantages of shrinking implied vols in our recent post. For more reading, refer the below weblink:

Eurostat’s flash estimate of Q3’16 Euro area GDP growth is not due until October 31. But, the French and German PMI statistics have been able to produce the upbeat numbers, giving an early indication of how the region would perform.

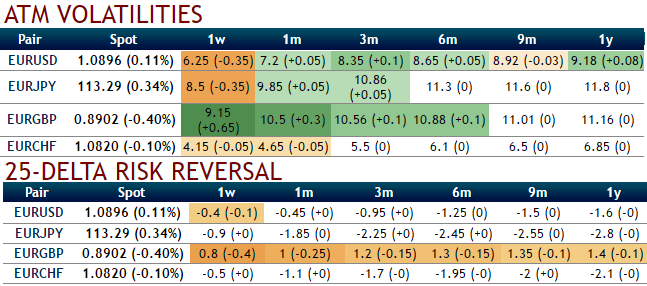

As a result, the implied volatility of EURJPY ATM contracts are shrinking away across all timeframes, crawling down at 8.5%, 9.85% and 10.86% for 1w, 1m and 3m tenors respectively.

With ECB event risk behind us, we double down on a EURJPY vol short this week by selling unhedged ranges through a condor structure(short put spreads + short call spreads).

The rationale still remains the same: EURJPY continues to screen as a relatively expensive gamma in the G10 world with realized vols running 1.0-1.5 vols below 1M ATMs, and a persistent presence in the top quartile of range trades on our DNT screens.

We continue to see the cross trading sans much directional impulse, in part because it is insulated from any sharp dollar trends heading into the December FOMC, and partly due to comparable policy dilemmas of the ECB and BoJ around additional easing ought to render the cross relatively inert to tapering/bond market stress.

We initiate a 2M 107-110-117-120 condor in the portfolio, but a double-no-touch (DNT) structure is also on the table for those not averse to short barrier risk.

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says