The GBP continued to weaken post-referendum, with EURGBP trading briefly above 0.86 and GBPUSD trading below 1.30 early in July. GBP has regained some of the losses, but TWI is still 10% weaker than pre-Brexit. EURGBP currently trading close to 0.84 and GBPUSD close to 1.32.

Interest rates have fallen post-Brexit, with gov’t bond yields down 30-60bps and 10y Gilts seeing new alltime-lows below 0.70%. 3 months interest rate difference (EURGBP) has risen 4bps last month. GBP 2017 FRAS have fallen 11-15 bps since June 24th, while EUR 2017 FRAS are up 2-3 bps.

Background: - Growth will slow due to increased uncertainty, negative trade effects and tighter financial conditions. - BoE will respond by an interest rate cut to -0.25%. The policy will remain at this low level to 2019. - The GBP will recover when uncertainty abates and fears of a severe negative economic outcome is reduced.

Watch list: - BoE’s monetary policy tomorrow would be key, with the inflation report seeing expected effects from Brexit on the real economy. Markets awaits further stimulus, pricing a 90% chance for 25bp cut in Bank rate and some looking for more QE.

As the British PMI for the manufacturing sector has missed the forecasts recently, a downward shift already would mean that sentiments are certainly not conducive for business in the UK, (actual 48.2 versus forecasts 49.1 and previous 49.1).

The focus today is likely to be on the final result of the equivalent for the service sector. According to the flash estimate the index had fallen to the lowest level since records began as a result of the Brexit shock.

EURGBP forecasts were : 0.86, 0.90 and 0.85 in 1,3 and 12 months.

Recommendation: None can’t disregard the Brexit-induced turbulence post event economic anomalies surrounding both the UK and Eurozone.

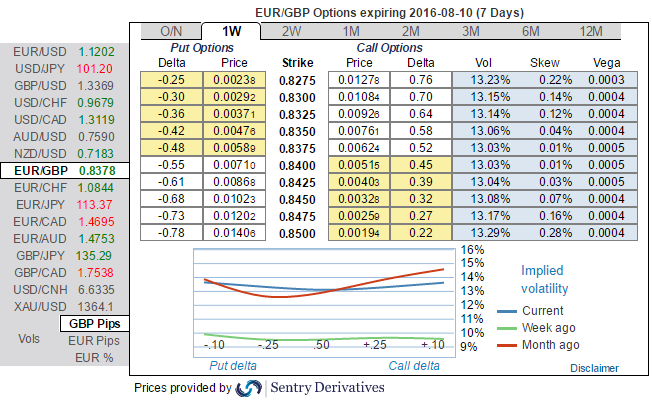

One can easily understand when they glance through IV nutshell for EURGBP skews, we reckon in conjunction with BOE’s monetary policy decision, Brexit uncertainty is preventing volatility to collapse.

Leveraged call spread thanks to high 2w volatility, EUR/GBP 2w vol still lures speculators, as it trades below the realised vol. The market should, therefore, experience larger spot deviations than what is discounted, making a tight call spread strikes 0.8150/0.86 naturally highly leveraged.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom