Although GBPUSD appears to be signs of recovery, reversal for the major downtrend needs better clarity. GeoPolitics is still posing a great threat to this recovery, so that a high level of volatility will most likely be preserved for some time. You could still make out GBP hedging sentiments for bearish risks in FX OTC markets.

Since the Brexit referendum and the 2016 US election, the two major upsets during the turbulent 2016, FX option markets have been sensitive on the issue of political event risk premium. The upcoming 2020 US election pricing are gearing to be one of the most eventful in history and as one possible driver capable of breaking the fragile state that global economy lies in at the moment.

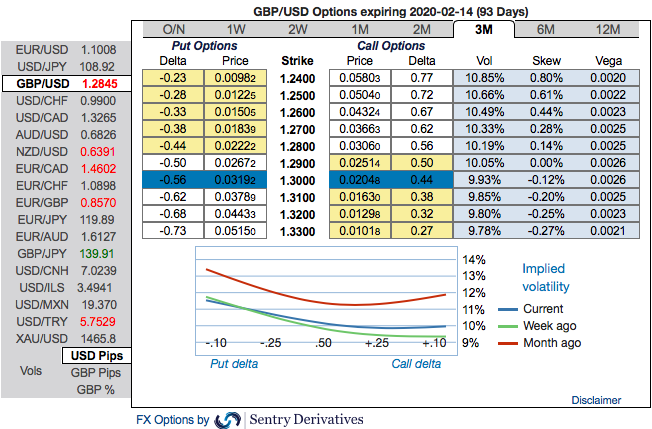

OTC outlook: The positively skewed implied volatilities of 2m tenors have still stretched towards OTM put strikes that indicates the hedging sentiments for the downside risks amid the minor positive shift in RRs.

To substantiate the downside risk sentiment, risk reversals have still been signalling bearish hedging sentiments despite some positive shift is observed in the bearish risk reversal numbers in the shorter tenors. Hence, we advocate below options strategy on both hedging and trading grounds.

Strategy (Debit Put Spread): Spot reference: 1.2846 level. Stay short sterling via a limited loss tail hedge: Stay short a 2M/2W GBPUSD bear put spread (1.3050/1.25).

The Rationale: Brexit deadline extension has been agreed by the EU, and the UK general election has been scheduled for December 12th, but how exactly the subsequent course of events in the UK plays out is still uncertain.

We perceive a post-general election Conservative majority to likely translate Johnson’s deal into UK legislation in a manner which raises no deal risks at end 2020 as a Conservative majority will bring with it a temptation to reopen the deal to address Brexiteer concerns. Conveniently, the trough of GBP term structure is currently at 1Y tenor, making an outright 1Y to 18M vega ownership attractive.

From the GBP OTC outlook, amid major downtrend we reckon that the sterling should not suffer like before, but, one should not disregard the UK elections and Brexit settlement risks on the other hand. The market has always ignored the fact that all the current BoE interest rate moves are due to a favourable result of the Brexit process.

The above nutshell exhibits IVs of G7 FX bloc on lower side. The prevailing sideway trend of GBPUSD, IV skews and risk reversals of 1w tenor if you consider, the underlying movement with lower IVs is interpreted as a conducive environment for writing overpriced OTM put options. While the underlying movement with lower IVs can also offer economical OTM option pricing.

However, the skews and RRs of long-term remain cautious about hedging of bearish risks that encompasses the above stated events (UK elections and Brexit deadline). Courtesy: Sentrix & Saxo

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand