RBNZ is due to release its monetary policy statement tomorrow, wherein it announces OCR rates which is likely to remain on hold. This is going to be the last monetary policy proclamation for the governor, Wheeler in this tenure who has served since September 2012.

The RBNZ’s OCR Review on Thursday morning (9 am NZT) is widely expected to keep the OCR on hold at 1.75%. There should be little change in guidance, given the interim nature of OCR Reviews (the Monetary Policy Statement in November includes a comprehensive update of its economic forecasts).

On the flip side, Fed Chair Yellen said the Fed should be wary of moving too gradually and that it is imprudent to keep the policy on hold until inflation reaches the 2% target. However she spent more time discussing downside risks to inflation, leaving markets with a mixed tone overall. Bostic was comfortable with a December hike. The fx moves were purely driven by the sentiment around the greenback, as the Asian traders digested Yellen’s hawkish remarks and Trump’s tax overhaul plan news.

We expect NZD to fall over the next 12 months, as growth will likely continue to underperform the RBNZ’s lofty forecasts (refer above chart), housing slows (refer above chart), and as tight financial conditions restrain any requirement for OCR hikes, allowing rate compression vs USD.

Hedging framework:

OTC Outlook and Option Trade Recommendations:

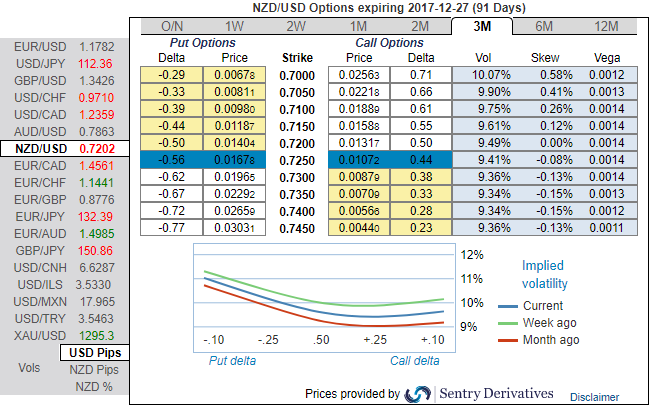

All the factors stated above seem to be discounted in FX options market, please glance through nutshell evidencing IV skews that signify hedger’s bearish interests in next 3-months timeframe. Positively skewed IVs of this tenor signal underlying spot FX is expected to be either edgy with sideways swings or lowering southwards as the skews have been well balanced flashing positive numbers on both OTM and ITM strikes. Accordingly, we’ve recommended credit put spreads in order to participate both upswings in consolidation phase and anticipated downside risks.

By now, writing 1m (1%) in the money put would have fetched us handsome yields snapping rallies upto 0.7558 levels in form of initial option premiums received. You could easily make out short legs on ITM puts of narrowed expiries are going worthless as anticipated. For now, we uphold longs in 3m at the money put, the structure could be constructed at the net credit.

Upon the mounting bearish risk sentiments are observed as you could see the positively skewed IVs in OTM put strikes of 1m tenors (refer positive IV skews indicate the strikes towards 0.70 which is our forecasts).

The combination of IV 1-3m skews suggested credit put spreads that has favoured to arrest ongoing upswings in short run and bearish risks are to be taken care by 3m ATM longs.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation