The US Federal Reserve maintained monetary policy unchanged last night, as broadly anticipated. The accompanying statement was a little more upbeat than before, noting the improvement in consumer and business sentiment. Importantly, though, there was no strong signal of a near-term hike. Domestically, the House of Commons voted to provide the government the ability to trigger Article 50 to start EU withdrawal negotiations by the end of March.

The Bank of England unanimously announces no change in policy today, leaving rates at 0.25% and the planned total stock of asset purchases at £445bn, and maintain the ‘neutral’ bias adopted in the November Inflation Report.

Notably, Governor Carney’s speech on 16 January repeated that monetary policy can respond “in either direction”, with the MPC for the moment choosing to tolerate a period of rising inflation. The data continue to bear out the UK economy’s post-referendum resilience, while further rises in inflation are coming down the tracks.

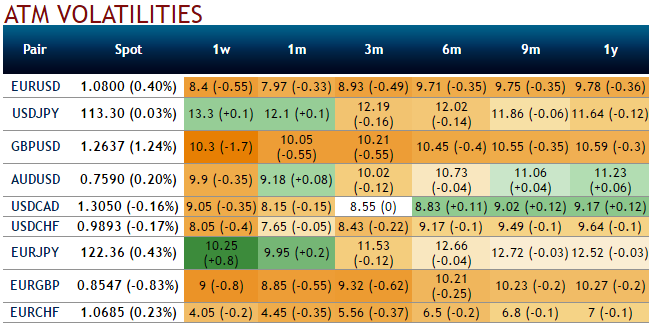

The UK would pursue a different future outside Europe, but the removal of uncertainty around the British stance should prove bearish for GBP volatility. Please be noted that the IVs of GBP crosses (especially EURGBP) has been reducing despite series data, such as the UK PMIs, BoE monetary policy. Accordingly, we’ve devised below option strategy.

Option-trade recommendations: (Writing a strangle)

For those whose foresee non-directional that is existed in this pair from the last couple of months or so to prolong in reducing IV scenario, prefer to remain in the safe zone, we recommend shorting a straddle considering IV shrinks.

Thereby, one can benefit from certain returns by shorting both calls and puts.

Thus, short 7D (0.5% OTM striking) put and (0.5% OTM striking) call simultaneously of the same expiry (preferably, short term for maturity is desired).

The strategy is likely to derive the maximum returns as long as the underlying EURGBP spot FX price on expiry keeps trading between 0.85 and 0.86 levels only as both the instruments have to wipe off worthless. So that the options trader gets to keep the entire initial credit taken as profit.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts