The pound sterling should not suffer too much. An interest rate hike by the Bank of England (BoE) next week is now the consensus opinion in the market. And so the fundamental difference between BoE interest rate policy and ECB interest rate policy is strengthened and made clearer. The market has always ignored the fact that all the current BoE interest rate moves are due to a favourable result of the Brexit process.

While the uncertain interaction between contingent trade war risks and the BoC policy reaction function adds to opaqueness in the rate outlook. The recent time’s policy communication from the BoC emphasized delineation between incorporating realized trade policy impact into its forecasts and policy decisions, and deliberately not taking account threatened but unrealized trade actions (e.g. potential future auto tariffs).

Despite drastic volatility in the energy markets, Western Canada Select Crude continues to trade at $50/bbl that stimulates CAD’s strength. If any headwinds in the form of domestic supply disruptions possibly into September (7.5% domestic daily production), plus pronounced spreads vs elevated WTI prices will limit CAD’s upside from additional oil price support.

Option Strategic Framework:

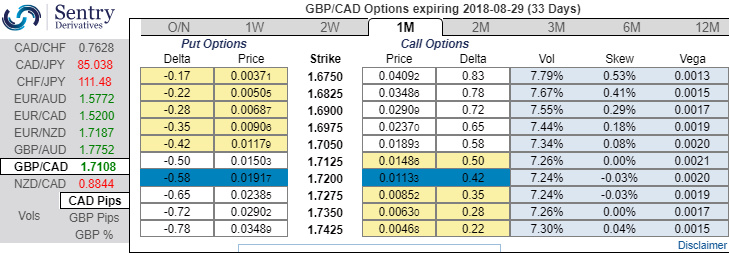

Please be noted that the positively skewed IVs of GBPCAD of 1m tenors is well balanced on either side (refer below chart), technical trend (both minor & major) and above stated fundamental driving forces of this pair have been indicating perplexities which means hedgers’ sentiments of this pair may head towards any directions but with more potential on downside in the near-term.

Accordingly, we advocate below options strategy that is likely to optimize hedging motive.

Strategy: 3-Way Options straddle versus OTM call

Spread ratio: (Long 1: Long 1: Short 1)

How to execute: At spot reference: 1.7941, initiate long in 1M GBPCAD at the money +0.51 delta call, add one more lot of 1M at the money -0.49 delta put and simultaneously, short 1w (1%) out of the money call with positive theta. The short leg with narrowed expiry (lower side) likely to reduce total hedging cost. Courtesy: Nomura

Currency Strength Index: FxWirePro's hourly GBP spot index is at shy above -17 levels (which is bearish), while hourly CAD spot index is edging higher at 65 levels (bullish) while articulating (at 10:24 GMT). For more details on the index, please refer below weblink:

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close