Australian central bank (RBA) is scheduled for its monetary policy next week wherein it announces cash rates. With the RBA expected to be on hold for the foreseeable future short-maturity interest rates are well anchored. While 3y swap rates have been in a 2.10 – 2.35% range throughout 2018.

The Aussie’s mid-August slide to 0.72 on Turkey-inspired global risk aversion left it quite oversold when judged by our short-term fair value estimate, which remains near 0.75. AU-US yield differentials have continued to drift in the US dollar’s favour in recent weeks but Australia’s key commodity prices have been mixed, overall a little higher since mid-August and a long way above March lows. Still, AUD risks probably remain to the downside in September (0.70 handle), given the confluence of FOMC meeting, US review of China tariffs and EUR/Italy budget risks. By year-end we see AUDUSD back to 0.73.

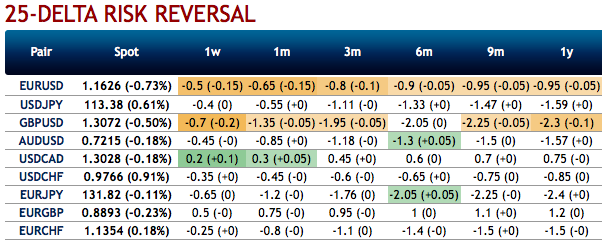

AUDUSD risk-reversals (RRs): AUDUSD RRs have been bullish neutral (refer above nutshell). It is disingenuous to include AUD in an EM list, but its China / commodity linkages have resulted in a price response this year not too dissimilar from other EMs, hence this (questionable) stretch.

With spec AUD positions fairly short on IMMs, there is room for a short squeeze higher in the currency that can dampen the elevated negative spot-vol correlation of recent weeks.

Thus, we intend shorting 3M 25D AUD puts vs 6M 25D AUD calls, vega-neutral in a box risk-reversal structure. This construct is net short gamma and skew, and can be construed as a moderately RV efficient way of selling AUD vol (refer 2nddiagram).

Currency Strength Index: FxWirePro's hourly AUD is flashing -26 (mildly bearish), hourly USD spot index is inching towards 84 levels (which is bullish), while articulating at (12:19 GMT). Courtesy: JPM

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts