Take a quick glance at some key fundamentals: As we continue to foresee the trade apprehensions ratchet up, the GBPUSD likely to prolong its apprehensions amid minor spikes in a typical “risk off” move.

While the bearish sentiments remain intact OTC markets. While Theresa May danced around the tricky details of Brexit in her concluding speech. Comments like “honouring the result of the referendum”, “seek a good trading and security relation” and Great Britain was not afraid to leave without a deal were met by enthusiastic applause. She dodged the word “Chequers plan”. With the exception of some sentences on Brexit, May focussed on other issues in her speech. As a result, her comments have to be seen in the context of her trying to appease the hardliners with boastful comments on domestic politics: they were not aimed at the EU. The reaction in Sterling was reserved, as there was an absence of meaty new statements.

On the flip side, the US dollar has risen over the past week, helped by strong data and bullish comments from Fed Chairman Powell. Today’s focus will be on US payrolls and earnings figures. Both the ADP and ISM reports point to a potentially strong outturn.

OTC outlook:

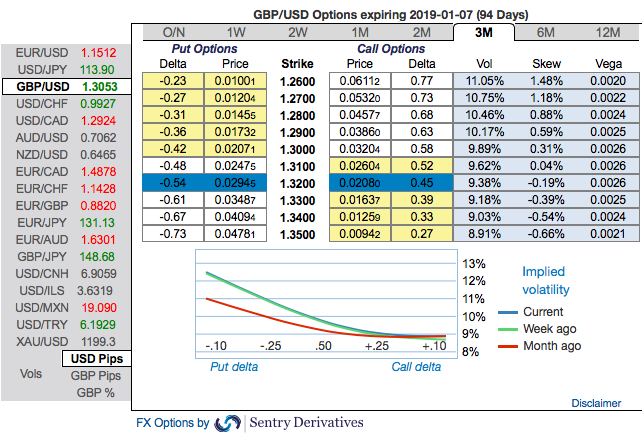

Positively skewed implied volatilities still signal bearish hedging sentiments. To substantiate this downside risk sentiment, risk reversals have also been bearish neutral, no change is observed.

We reckon that the sterling should not suffer like before, but, one should not disregard Fed’s hiking cycle on the other hand. The market has always ignored the fact that all the current BoE interest rate moves are due to a favourable result of the Brexit process.

Both the speculators and hedgers of GBPUSD are advised to capitalize on the prevailing price rallies for bearish risks and bidding theta shorts in short run (1m IVs) and 3m risks reversals to optimally utilize delta longs.

On hedging grounds, fresh delta longs for long-term hedging comprising of ATM instruments and OTM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 1m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, initiate longs in 3m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

Thereby, the above positions address both upswings that are prevailing in short run and bearish risks in long run by delta longs.

The political and economic backdrop remains supportive of sterling’s underperformance. We continue to be short but take partial profits by unwinding the GBPUSD expression of the trade since this is currently in the money but has only less than a week to expiry and is close to the strike.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 98 levels (which is bullish), and hourly USD spot index has bearish index is creeping at 22 (mildly bullish) while articulating (at 11:49 GMT). For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays