The bullion prices continued to trend higher last week (spot prices up 1.6% wow to end the week above $1,780/oz). Gold front month ATM vol ended last week where it started, at around 16 vols. We refer JP Morgan’s machine learning based 1M ATM vol model has been showing a moderate sell vol signal for the past week so we are leaning towards selling short term near the money vol.

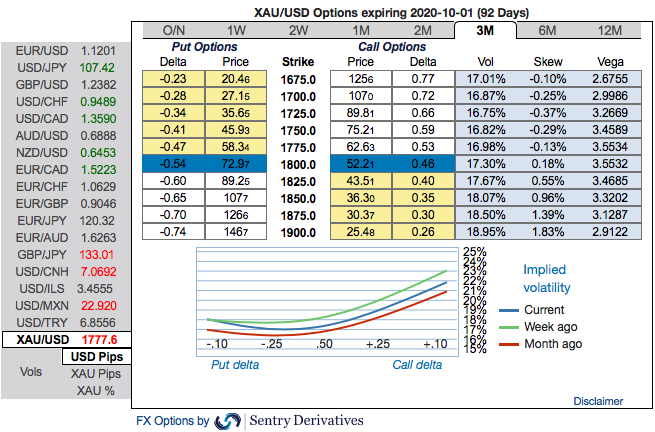

The 3m positive skewness of gold options contracts implies more demand for calls (refer 1st chart). These skewed IVs of 3m XAUUSD contracts are still indicating the upside risks, bids for OTM call strikes up to $1,900 is quite evident that reminds us hedgers’ inclination for the upside risks.

One could also see the fresh negative bids for the existing bullish risk reversal setup. To substantiate the above-mentioned bullish sentiment, risk reversal (RRs) numbers also indicate the overall bullish environment (2nd nutshell). Well, we know that options are predominantly meant for hedging a probable risk event in future.

We also expect the extremely strong positive gold spot momentum to continue and so we recommend selling 3M ATM puts for 17.01% vols and buying 3M 25D puts for 18.95% vols with an equal notional, indicatively.

Hedging Strategies:

Capitalizing on all the above fundamental drivers and OTC indications, we advocate longs in gold via ITM call options as they look to be the best suitable at this juncture.

Thus, we still advocate buying 3m XAUUSD (1%) ITM -0.69 delta calls on hedging grounds. If expiry is not near, delta movement wouldn’t be 1-point increase with 1 pip in the underlying movement, which means if the spot moves 1 pip, depending on the strike price of the option, the option would also move less than 1.

Thereby, in the money call option with a very strong delta will move in tandem with the underlying spot gold prices as we could foresee more upside risks and intensified buying interests on safe-haven sentiments amid geopolitical turmoil and the global financial crisis. Courtesy: Sentry and Saxobank

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close