A possible bottoming out in inflation and the Fed repricing of a December hike are outright bearish and gold should rebase lower. To this end, the median Fed participant continues to look for one more hike this year, and three more to go in 2018. The 2019 median path was trimmed from three hikes to two, offsetting the somewhat hawkish near-term message.

The market expectations, however, are quite different. Still awaiting a stronger confirmation of a sustained upward trend in inflation, the market is only pricing in less than two full hikes by December 2018, which seems overly pessimistic given the upbeat economic backdrop. This complacency on the Fed is mostly due to the fact that the Fed had signaled its rate decisions would be primarily driven by inflation, which until August surprised to the downside over five consecutive months.

The repricing is already taking hold. Three weeks ago, the rate markets priced no hikes through 2018; today it’s almost two. December hike probabilities have now risen to almost 63% from 28% just two weeks ago. But we expect more.

The four Fed-related corrections so far this year averaged sell-offs of $28/oz, $58/oz, $76/oz and $84/oz each, with the current sell-off surpassing $50/oz so far. Considering the higher starting point, we believe the downside trade has room to play out further. While further weakness in the broad dollar and re-escalation of political tensions could lend some support to bullion prices, we continue to caution against holding gold as a political hedge during the global rate normalization cycle.

As you can observe that today’s gold price rallies have been snapped by cautious bears in as soon as the price touches $1283.64 where it sees stiff resistance at 7DMA mark.

Went short Dec’17 CME gold at a price of $1,318/oz on September 20, 2017. We continue to uphold the position for the commensurate trade target upto $1,190/oz with a strict stop 1 at $1,294/oz and stop 2 at $1,306.

Option Trade Recommendations (Credit Put Spreads):

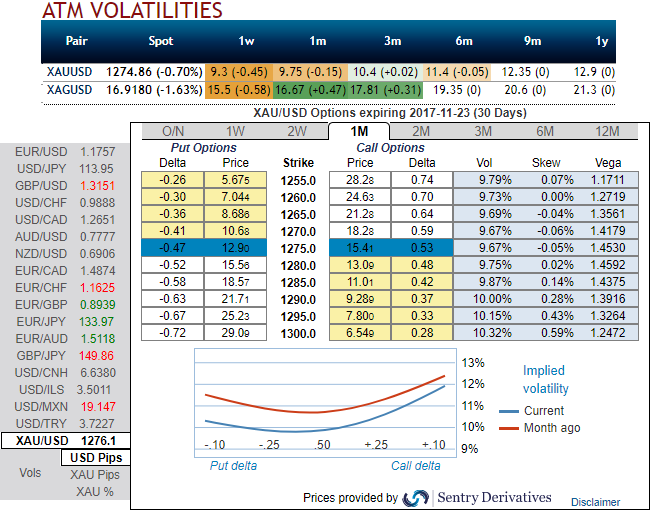

The XAU (gold) volatility market normalized sharply (you could observe that in XAUDUSD IVs across all tenors) and IV skewness is quite favorable for ITM put option holders, synthesizing this with ongoing trend of this pair, we eye on writing overpriced in the money put options that likely to reduce hedging costs of long legs.

Hence, we foresee opportunities in writing ITM put during shrinking IVs with positive skewness to OTM calls.

At spot reference: $1275, one can also deploy diagonal credit put spreads by writing 1m (1%) in the money put while initiating longs in 3m at the money put, the structure could be constructed at the net credit.

Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing

Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts