Bearish EURUSD scenarios:

1) A loss of confidence in Italian fiscal policy that pushes BTP spreads to 400bp and undermines banks,

2) A resumption of the EM sell-off boosts USD due to the prevalence of cross-border FX funding in USD.

3) Growth gets stuck below 2% and ECB hikes only in 2020

Bullish EURUSD scenarios:

1) Growth rebounds to 2.5-by end-2018;

2) ECB becomes more comfortable with progress on wages and core inflation and softens its calendar guidance for hikes

Latent trigger events:

Growth and inflation data.

ECB policy

Italian fiscal situation (EU Commission response late Oct, ratings agencies)

Global risk markets, EM, US trade policy.

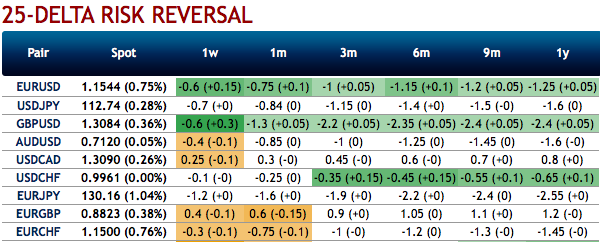

OTC Outlook: Please be noted that the positively skewed IVs of EURUSD of 2m tenors signify the hedging interest of bearish risks.

While the risk reversals across all tenors show shift towards positive numbers but downside risks remain intact in the major trend, bearish risk sentiment remains intact.

Well, contemplating above-stated driving forces and OTC indications, options strips strategy is advocated on both trading as well as hedging grounds. The options strips strategy which contains 3 legs needs to be maintained with a view to arresting price downside risks. You could observe mounting hedging operations in EURUSD (highest among G7 FX space).

Option Strategy: Options Strips

Combination ratio: (2:1)

Rationale: Considering the bullish (in near-term) and bearish technical environment (in long-term) and most importantly, the skews in the sensitivity tool indicate hedging sentiments for the bearish risks, these risks are coupled with bearish risk reversal numbers.

The execution: Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 2M tenors, go long 2m at the money +0.51 delta call option simultaneously.

The strategy can be executed at net debit with a view to arresting FX risks on both sides and likely to derive exponential returns but with more potential on the downside.

Currency Strength Index:FxWirePro's hourly EUR spot index is showing 1 (which is absolutely neutral), while USD is flashing at 122 (which is bullish), while articulating at (09:18 GMT). For more details on the index, please refer below weblink:

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes