RBNZ is due to release its monetary policy statement tomorrow, wherein it announces OCR rates which is likely to remain on hold. This is going to be the last monetary policy proclamation for the governor, Wheeler in this tenure who has served since September 2012.

We foresee, ahead of RBNZ’s OCR Review and BoJ governor Kuroda’s speech, NZDJPY likely to sense volatile moves in the upcoming trading sessions.

You could easily figure out from the technical charts of recent past, it has shown a considerable resilience, (observe bearish candles with big real bodies, refer above technical chart), we continue to see the same in next two days’ time.

Before describing the Vega longs, let’s begin with volatility.

The volatility of any asset price (NZDJPY currency pair in this case) is simply how much it fluctuates with no regard to direction. A higher volatility means the price has moved or is expected to move over a larger range in a set time period.

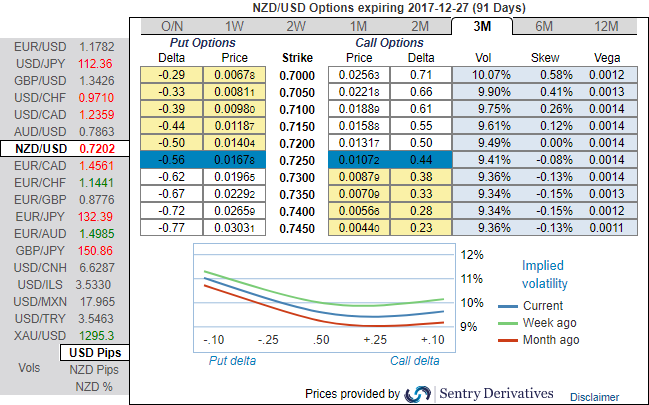

Please be noted that the implied volatility of the call options of NZDJPY is trending higher at 11.38% and 10.61% for 1w and 1m tenors respectively.

Future volatility is the volatility of the underlying price over some period in the future. The price of an option depends on future volatility, yet it is impossible for anyone to know exact future volatility. However, it is possible to calculate the market place’s expected future volatility using the option’s price itself. This is known as implied volatility (IV).

Vega longs are contemplated in this strategy as it measures the sensitivity of an option’s value to a change in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

The RBNZ has signaled the next cycle in the previous minutes – a tightening one – would not begin until the end of 2019. That will anchor the short end, although markets will not abandon their expectations for tightening as early as mid-2018 which means occasional spikes in the 2yr swap rates will be likely.

Well, in order to arrest the puzzling swings that are lingering in intermediate trend and prevailing declining trend, we recommend diagonal option strap strategy that favors underlying spot’s upside bias in long run and mitigates bearish risks in short term.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 2 lots of 1M ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of 2w expiries, the strategy is constructed at net delta of 50% as shown in the diagram.

This NZDJPY strategy should take care of both upswings and downswings simultaneously, and on speculative grounds the strategy is likely to derive handsome returns on the upside and certain yields regardless of swings on either side but with more potential on upside, thereby, one can achieve trading or speculative objective.

Straps are likely to render buyer the right to buy underlying spot FX at predetermined regardless of the trend with the limited risk to the extent of initial premium paid, thereby, hedging objective can also be attained. This strategy is used when the options trader ponders over the underlying spot price would sense significant volatility which seems most likely ahead of central bank events as stated above.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data