The domestic macro pressures are increasing pressure on the CNB to exit the EURCZK floor. In our view, upside inflation surprises and stronger growth momentum warrant a shift towards tighter monetary policy, which should drive CZK appreciation following the exit from the floor.

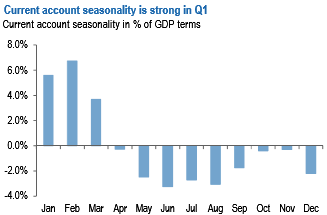

The headline inflation is projected to rise in 2017, and twin current account and fiscal surpluses provide currency support. We note that current account seasonality pressure is strongest in Q1 (refer above diagram), which is a further supportive factor for CZK strength.

Headline CPI inflation data for December is released next week (10th January), and further upside surprises are likely to increase pressure on the CNB to exit the floor sooner rather than later and may spur a further near-term fall in EURCZK forward points. However, we note that the central bank has recently downplayed upside inflation surprises.

The CNB maintains that mid-2017 remains the most likely exit from the EURCZK floor. Interestingly, the market is currently pricing negative policy rates at the time of the exit to smooth the transition, but we view this as a low probability event.

The minutes from the CNB December meeting state that negative rates would be inconsistent with exiting the EURCZK floor, as this would occur at a time of “expected gradual tightening of the monetary conditions”.

Hence, we maintain to hold short 27-Nov-17 EURCZK forwards, and think current levels for 1y EURCZK forwards still offer attractive entry points for a bullish CZK expression.

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices