Inflation in the UK is scheduled to be announced shortly, Sterling most likely to rise if upbeat UK CPI boosts BOE rate hike bets as December’s UK CPI report headlines the economic calendar in European trading hours (consensus are at 3.0% for now).

Consumer prices in the United Kingdom rose by 3.1 pct in the year to November 2017, following a 3 pct gain in the previous month and beating market expectations of 3 pct. It was the highest inflation rate since March 2012, mainly due to rising prices of transport, leisure activities, restaurants and hotels, housing and food.

Well, it is projected that the three years of real GDP growth below 1% in 2018-2020, averaging 0.8% per annum, about a quarter of the world’s average growth rate. On a positive note, that ought to be enough to shrink the current account deficit to under 2½% GDP, but that’s a Pyrrhic victory, opening the door for an upside surprise that feeds BOE rate hike speculation, boosting the British Pound.

On the flip side, RBA has been maintaining the cash rate unchanged at 1.5% in its previous meetings, with post-meeting comments by Governor Lowe highlighting that the outlook for non-mining business has improved, but concerns remain around household consumption. Wage growth remains slow, while debt levels remain high.

Well, as stated in our previous post, all the above-mentioned macros standpoints have been propelling GBPAUD swing oscillation on either side but more downswings potential for now.

Amid this prevailing puzzled environment, you could observe that the momentary bulls of GBPAUD struggle to break and sustain above stiff resistance of 1.7365 levels, currently trading in non-directly to signal some bearish pressures. Accordingly, we’ve advocated below hedging strategy with cost-effectiveness about two months ago. These positions have hedged the FX risks of this underlying pair regardless of the swings on either side. Hence, we would like to roll on tenors to maintain the same positions.

Hedging Framework:

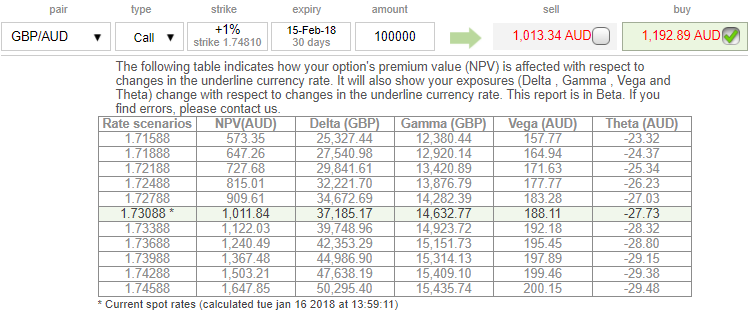

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

The execution: Initiate long in GBPAUD 3M at the money -0.49 delta put, long 2M at the money +0.51 delta call and simultaneously, short theta in 1m (1%) out of the money call with positive theta or closer to zero.Theta is positive; time decay is bad for a buyer, but good for an option writer.

Rationale: Please be noted that 3m skews are stretched on either side, ATM options have more likelihood to expire in the money and the 1m IVs are just shy above 8.87%, whereas 1% OTM calls of this tenor seem to have been overpriced at 18% more than NPV, hence, we foresee writing such exorbitant calls amid bearish pressures are beneficial as there exists the disparity between IVs and option pricing.

Hence, we encourage vega longs and short thetas in the non-directional trending pair but slightly favors bearish strategy as the vega signifies the sensitivity of an option’s value owing to a shift in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

Currency Strength Index: ahead of UK’s CPI data announcement FxWirePro's hourly GBP spot index has turned to 66 (which is bullish), while hourly AUD spot index was creeping up at shy above 19 (mildly bullish) while articulating (at 08:36 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close