Rates analysts across the globe know that the dollar needs yield support, while the correction is on track. The Federal Reserve began its hiking cycle since Christmas season of 2015 by increasing its key interest rate by 0.25% (it was just the second time in a decade that the Fed has raised rates) and again on the same festive season (December 2016) by 25 bps, followed by 2 more hikes in this current year by 50 bps.

Thereby, it signified the Fed's confidence in the improving U.S. economy. Rising rates will affect millions of Americans, including home buyers, savers and investors.

For now, the dollar’s stronger overnight, in response to Janet Yellen’s hawkish rhetoric while delivering speech at the NABE annual conference. But, it’s up by no more than 0.4% against any currency.

10year Note yields are also only slightly higher, at 2.25%, which has dragged JGBs up 2bp to 4bp and German Bund yields up a basis point to 41bp. The dollar correction is underway, but it needs a good bit more (US) yield support if it’s going to gather real momentum. Still, with this kind of reaction in the Treasury market, the Fed isn’t threatening risk sentiment too much. There, the challenge remains geo-politics and the war of words between the US and North Korean leaders. While all speculative eyes are activated on this Christmas monetary policy season by Fed.

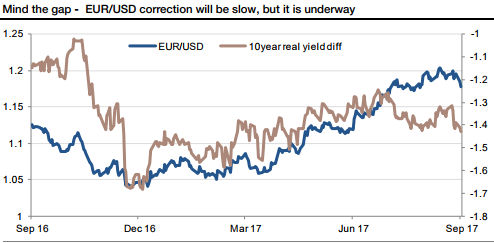

The most encouraging fact for EURUSD bears is that with the market now pricing a 70% chance of a December Fed rate hike, the futures market is pricing a near-2% gap between 3- month rates in euro and dollars in 2 years’ time. That’s similar to what was being priced in the spring, when EURUSD was trading at around 1.10. It isn’t realistic to expect EURUSD 1.10 to be revisited any time soon but a further correction seems likely, closing some of the (clearly visible) gap in recent trends in rates and currency.

If the EURUSD correction is alive and well, then short GBPUSD is an attractive short-term bet, as is short GBPCAD. This morning sees UK CBI distributive sales survey data, but those might not tell us too much.

Ideally, we would like to be short GBPUSD at about the same time as the UK rates market prices a better than 50% chance that we will see two rate hikes in the coming months. At the moment, the market doesn’t price a second hike as ‘more likely than not’ until next May. The problem with that is that the dollar bounce is likely to happen now, or not at all. So timing isn’t perfect but even so, as we drift below 1.34 in GBPUSD, the August spike to 1.3270 is the next obvious target. After that, talk of a return to 1.30 will start.

One side-effect of the correction in EURUSD has been that PLN and SEK, both of which we like, have fallen further against the dollar than the euro has. That’s not a new pattern and points to heavy positioning, as many people bought ‘euro-alternatives’ rather than the real thing, earlier this year. The upshot is a sizeable bounce in GBPSEK and GBPNOK this month, the former reversing over half of the fall since late May. We like these trades in the long-run (both of them) but it’s been a bruising month. Courtesy: SG

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks