The euro has scope to trade into a lower range below 1.12 if the European Central Bank (ECB) strikes a dovish tone at its governing council meeting on April 10. The ECB may, after its surprise TLTRO III announcement on March 7, follow through with a tiered deposit rate to help banks cope with the weak Eurozone economy. EURGBP has been oscillating between a tight range of 0.8994 – 0.8282 levels, but the major trend remains puzzling even though bearish bias in the minor trend.

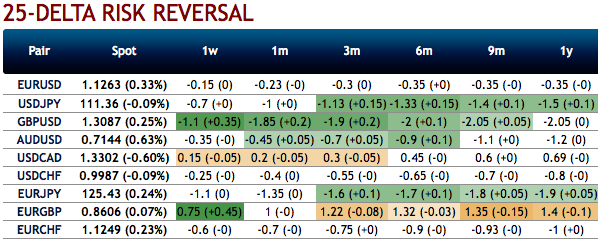

Well, let’s just quickly glance at OTC outlook before looking at the options strategies.

Fresh positive bids in the shorter tenors of EURGBP have been observed to the broader bullish risk reversal outlook in the FX OTC markets, this is interpreted as the hedgers are still keen on bullish risks, while the pair displays 10% of IVs which is the highest among G10 FX space.

While positively skewed IVs of EURGBP has also been stretched out on OTM Calls. This is conducive for options holders of OTM call options.

Hence, 3-way options straddle seems to be the most suitable strategy for EURGBP contemplating some OTC sentiments and geopolitical aspects.

Sterling has been able to appreciate significantly as the Geopolitical surface considering the UK Parliamentary developments from the last week’s “meaningful” vote will continue to dominate the domestic focus. Until that emerges the risk of a no-deal Brexit remains in place, leaving the risk of Sterling setbacks high.

It remains more expensive to hedge against strong GBP depreciation, which means that an orderly Brexit in whatever shape is still seen as being more likely. However, the risk of things going wrong is high and as a result, we regard any GBP appreciation with much skepticism.

You see any fresh positive bids in EURGBP risk reversals to the existing bullish setup, it should not be perceived as the bearish scenario changer. Instead, below options strategy could be deployed amid such topsy-turvy outlook.

Options strategy: Keeping above seesaw geopolitical and hedging sentiments under consideration, 3-way straddles versus ITM calls are advocated, the strategy comprises of at the money +0.51 delta call and at the money -0.49 delta put options of 1m tenors, simultaneously, short ITM puts of 1w tenors. The strategy could be executed at net debit but with a reduced trading cost.

Hence, on hedging as well as trading grounds, initiate above positions with a view of arresting potential FX risks on either side but slightly favoring short-term bearish risks. Courtesy: Sentrix and Saxo

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 78 levels (which is bullish), while hourly GBP spot index was at -176 (highly bearish) while articulating (at 12:37 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic