Amid the prevailing risks for the slowdown in the global economy, the yen is, on the one hand, in demand as a safe-haven, while on the flip side, it is likely to become more and more obvious in the course of the easing efforts of other central banks that the Bank of Japan will hardly be able to further ease its monetary policy in a credible manner.

Conceptually, the BoJ would have to stop buying bonds at the long end, or even sell JGBs, to defend its yield target. But in light of an inflation that remains close to zero that would be a totally inappropriate restrictive signal which would likely increase the appreciation pressure on the yen substantially. The BoJ recently reduced its purchases at the long end slightly, but there was no significant effect on the yield curve. And at the short end, downside potential is limited by the key interest rate. Since the Bank of Japan has included the cost considerations for the financial sector in its monetary policy decisions, a further permanent easing of Japanese monetary policy - to the extent that it is possible at all - is not credible. Instead, the market will always quickly speculate on a possible normalisation of monetary policy as soon as the economic environment brightens even a little - which would then allow the yen to appreciate again.

In relative terms, the BoJ thus threatens to become more restrictive, especially compared to the Fed, which is why we expect the yen to appreciate significantly against the USD. Since the European central bank (ECB) is also in a similar dilemma to the BoJ and its monetary policy arsenal has practically dried up, we expect EURJPY to move broadly sideways in the near-terms while the major downtrend remains intact. ECB is scheduled for their monetary policy next week.

Contemplating all these underlying factors, euro seems to be edgy on increasingly chronic underperformance of the Euro area economy. We could foresee reasonably bearish risks for EURJPY amid such backdrops.

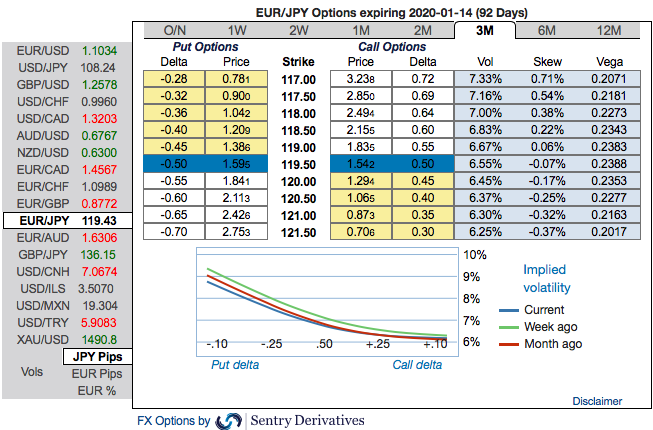

OTC outlook (EURJPY): We noted in our recent post that the positively skewed IVs of 3m tenors signifying the hedging interests for the downside risks. There is no much change in our hedging outlook, as the bids for OTM puts expect that the underlying spot FX likely to show further dips so that OTM instruments would expire in-the-money.

Most importantly, to substantiate the above indications, we could see some minor positive shifts in existing bearish risk reversal set-up of EURJPY that indicates the long-term hedging sentiments across all tenors are still substantiating bearish risks amid minor abrupt upswings in the short-term. Please be noted that 3m IVs are overall OTC barometer is noteworthy size in the forex options market that can stimulate on the underlying forex spot rate.

Options Strategy: Contemplating above factors, we’ve advocated buying 3m EURJPY (1%) ITM -0.79 delta puts for aggressive bears on hedging grounds as the mild abrupt upswings were contemplated earlier.

Short hedge: Alternatively, we advocated shorts in futures contracts of mid-month tenors with a view to arresting potential dips. since further price dips are foreseen we would like to uphold the same strategy by rolling over these contracts for September month deliveries. Source: Sentrix, Saxo & Commerzbank

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing

Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025