Euro area composite PMI post a solid gain in October, signaling 1.8% ar GDP growth.

Improvement was broad-based by sector and country and was reinforced by IFO and EC surveys

Last week’s Q3’16 flash GDP prints an unchanged 0.3% QoQ, SAAR growth, with modest downside risks, while Japan managed to produce an upbeat numbers of 0.5% versus forecasts of 0.2% and previous 0.2%.

October flash inflation report to show core inflation stuck at 0.8%oya.

On data front, the major focus -

For today:

EMU: ECB’s Draghi to speak

Sweden: Riksbanken’s af Jochnick to speak

Highlights rest of the week:

Tuesday: Consumer confidence in Norway in Q4

Wednesday: FOMC minutes from November meeting

Thursday: German IFO index in November

Friday: Japanese CPI inflation in October

From a recent visit of our reporters, we reckon given the recent US election, there were significant concerns on what a Trump presidency would mean for Japan, China, and the Asia region more broadly.

The pivot from monetary to fiscal policy was also a major topic for discussion. Investors have been shocked by the significant sell-off in global rates markets which look particularly acute against the moves in Japanese yields.

Other significant topics were commodity prices, the valuation of Semi government bonds, the cross currency basis market and debt issuance trends.

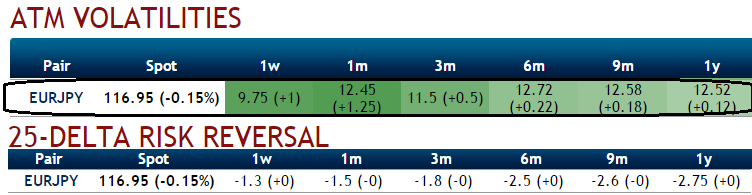

Ahead of today’s Draghi’s speech, 1w IVs of this pair are rising but you could make out from the skewness of these IVs that are reluctant to signify their interest on either of the spot FX moves but 1m skews signify hedgers' interests in OTM put strikes.long-termng term foreign traders firmly destined to hedge the further downside risks. Let’s also observe 1w risk reversals with positive flashes, compare these computations with ongoing rallies of EURJPY, hence, we reckon capitalizing these rallies optimally utilize in our below option strategy.

Hedging Positioning:

“Short 1w (1%) ITM put option, go long in 1 lot of long in 1m ATM -0.49 delta put options and another 1 lot of (1%) OTM -0.36 delta put of 1m25d tenor.” Using diagonal tenors would keep us hedging positions riskfree as well as reduces the cost of hedging to almost 50%.

The position is a spread with limited loss potential, but varying profit potential. The degree of profit relies on the strength and rapidity of price movement. The position uses long and short puts in a ratio, such as 2:1, to maximize returns.

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays