EURUSD short-term implied valuations remain oriented south (preference to stay top heavy), perhaps in anticipation of a slightly less confident ECB going ahead. Expect resistance towards 1.2290 and the 55-day MA (1.2339) thereafter, while the downside is expected to remain supported on the approach of 1.2200 and the 100-day MA (1.2158).

Option Strategy: Options straddle

Combination ratio: (1:1)

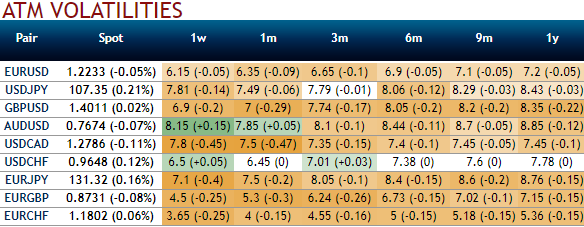

Rationale: Contemplating above mentioned technical environment, and ATM implied volatilities of 1m expiries are below 6.5% which is on the lower side among G7 currency segment (2nd least after EURGBP) and hence, likely bounce back.

Let’s glance at the above nutshell that indicates tepid hedging sentiments. The skews in the sensitivity tool seem well balanced on either side, the positively skewed IVs are stretched on both OTM calls and OTM puts in 1m timeframes.

In addition to that, let's glance on OTM strikes, %change in premiums and %probabilities in hitting these strikes on expiration that keeps us eyeing on shorting expensive calls with shorter expiries in conjunction with ATM straddles.

Based on this rationale, cautious hedgers can initiate the below-stated options strategy. In order to arrest both this upside and downside risks that are lingering in short-term trend, we recommend deploying options straddle strategy.

The execution:

Go long in EURUSD 1M at the money delta put, go long 1M at the money delta call and simultaneously.

Margin requirement: No.

Description: Trade the expectation of increased volatility without taking a view on any particular direction. A strategy usually utilized over significant economic data events and other political events.

Data points to watch include US March CPI readings on Wednesday, China March monetary aggregates (sometime this week), China March CPI/PPI readings on Wednesday, as well as China March trade numbers on Friday. On the central bank front, the BOK is expected to remain static at 1.50% on Thursday. This week, FOMC minutes are due on Wednesday while Fed appearances are penciled in from Tuesday to Friday.

Effect of Volatility: Directly proportionate to the volatility, the value of both options premiums would likely to enhance as volatility increases (good) and will decrease as volatility falls (bad).

Please be noted that the strategy likely to fetch positive cashflows regardless of the swings with more potential on the downside. Hence, one can deploy this options strategy on hedging as well as speculative grounds.

Currency Strength Index: FxWirePro's hourly EUR spot index is displaying shy above 21 levels (which is mildly bullish). While hourly USD spot index was inching towards -63 (bearish) while articulating (at 07:03 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate