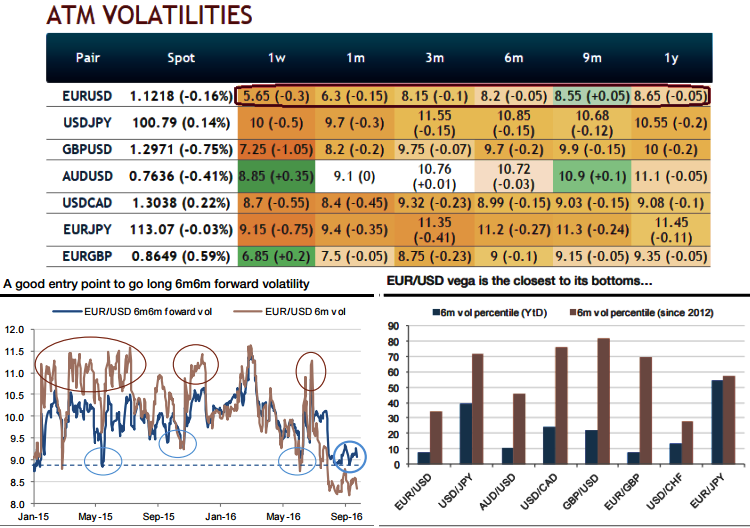

FX volatility entered a moderate regime in early 2015 but since July has come under significant pressure and is experiencing an unusually long period of stability. The current lows suggest multi-month volatility hedges, as in the medium term central bank activity will increase and political risk will stay high (US election, post-Brexit formalities).

EURUSD is the pair to perceive the least IVs among G7 currency space. An unusually long period of low volatility of volatility is going to be concerning given that volatility is not that low.

The above-stated factors would not essentially propose that volatility is going to spike imminently, but it could become more supported over the medium term. You can also observe the vega is the bottom levels for this pair, we understand that the vega is the sensitivity of an option’s value to a change in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

If the options market starts sharing this belief, volatility curves will tend to steepen in their vega segment. It is, therefore, attractive to consider buying multi-month forward volatility.

EUR/USD has the most value In FX G10 space, the universe of the most liquid currencies is constituted by the following eight pairs, in decreasing order: EURUSD, USDJPY, AUDUSD, USDCAD, GBPUSD, EURGBP, EURJPY, and USDCHF.

Among the lot EURUSD 6m volatility is currently trading at 8.5, and in this universe is closest to the lows observed since both the start of the year and 2012 (see the above IV nutshell and graph).

Only USDCHF volatility is slightly closer to its bottom observed since 2012. Conversely, JPY volatilities are found to be the highest.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different