In emphasizing downside risks to the outlook, Powell has defused the immediate risks of a disruptive back-up in bond yields. This has put a cap on the broad dollar. Bond proxies in FX such as CHF and JPY have been spared a potential fixed income VAR shock.

That being said, we do not believe that Powell has given a green light to sell USD indiscriminately. Nor do we see it as a reason to embrace pro-cyclical FX as the global economy continues to come up short. This macro backdrop still warrants strategically overweighting defensive FX in G10 irrespective of Fed easing.

ECB has been scheduled for its monetary policy on July 25th, and EUR has been resilient to the latest under-delivery from the region’s economy. But with the ECB no longer content to sit this out, the downside threat to EUR is becoming more tangible. QE1 depressed euro by 12% on the ECB’s own estimates.

ECB minutes were dovish but not as dovish as Draghi’s speech in Sintra. The minutes of the ECB’s June meeting were dovish, as was our reading of the meeting at the time, but not necessarily as dovish as Draghi’s speech in Sintra (with the caveat that Draghi’s speech was clearer about the need to act again than about the required magnitude of the policy move).

OTC Outlook:

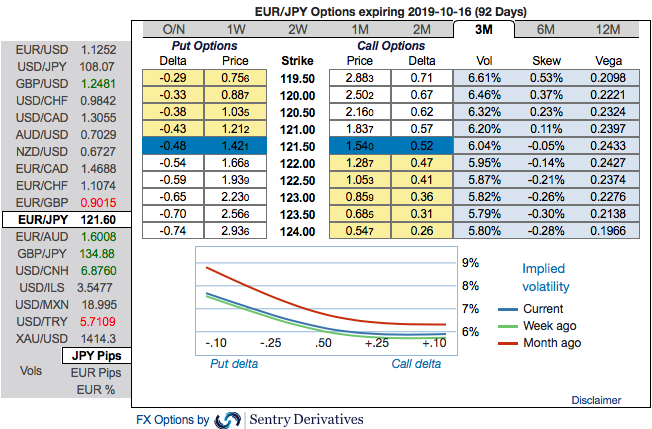

Hedging skewness (EURJPY): Please be noted that the positively skewed IVs of 3m tenors that are also signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors expect that the underlying spot FX likely to break below 119.50 levels so that OTM instruments would expire in-the-money.

Risk reversals Substantiate Skews (EURJPY): Most importantly, to substantiate the above indications, we could see some minor positive shifts in existing bearish risk reversal set-up of EURJPY that indicates the long-term hedging sentiments across all tenors are still substantiating bearish risks amid minor abrupt upswings in the short-term. Please be noted that 3m IVs are overall OTC barometer is a noteworthy size in the forex options market that can stimulate the underlying forex spot rate.

Options Trade Recommendation (EURJPY): We’ve advocated buying 3m EURJPY (1%) ITM -0.79 delta puts for aggressive bears on hedging grounds as the mild abrupt upswings were contemplated earlier.

Alternatively, we advocate shorts in futures contracts of mid-month tenors with a view to arresting potential dips. Source: Sentrix and Saxobank

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data