The EURCHF exchange rate has already eased back below the 1.13 mark and has therefore returned into areas that are likely to begin causing the Swiss National Bank (SNB) discomfort. SNB is scheduled for its monetary policy meeting next week.

Technically, the pair has tumbled below 1.1376 (i.e. 21-EMAs) and for now, on the verge of retracing 50% Fibonacci levels with intensified bearish momentum.

The Swiss central bank had seemed much more relaxed as regards the exchange rate when it climbed from levels around 1.10 to above 1.14 last year. Even though inflation in Switzerland is positive again, core inflation has remained at only 0.5% since the start of the year, which is anything but comfortable.

Driving forces of EURCHF:

1) Protracted EM stress and deleveraging of FX-funding.

2) Systemic Euro area stress on aggressive Italian fiscal easing.

3) The ECB delays rate hikes into 2020.

OTC updates and trade recommendations: (Short in EURCHF at 1.1392, spot reference: 1.1295 levels)

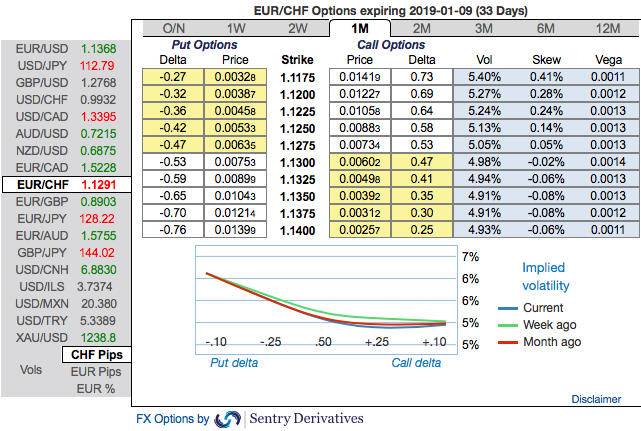

EURCHF risk reversal numbers and positively skewed of implied volatilities of 1-3m tenors signify the bearish risks to prevail further.

25-delta risk reversals indicate the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market. Negative bids indicate puts are more expensive than calls (downside protection is relatively more expensive).

Accordingly, we advocate 2m (1%) in the money -0.79 delta put options, the rationale for choosing such derivative instrument is that the in the money put with a strong delta would move in tandem with the underlying downward moves.

Currency Strength Index: FxWirePro's hourly EUR spot index has shown 102 (which is bullish), while hourly CHF spot index was at 76 (bullish), while articulating at 09:32 GMT. For more details on the index, please refer below weblink:

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist