The UK labour market figures for the 3 months to July continue to paint a benign picture broadly maintaining previous pre-referendum trends. The unemployment rate held at 4.9%, as expected, a low level at which capacity constraints might typically be expected to put upward pressure on wages.

The UK central bank (BoE) responded to the recent Brexit shocks by easing in its monetary policy, to keep bank rates at record lows of 0.25%, while launching a package of measures designed to provide additional monetary stimulus that includes, among others, the purchase of up to £10 billion of UK corporate bonds and an expansion of the asset purchase program for UK government bonds of £60 billion. In today’s BOE guidance is likely to add pressure on GBP although any change in monetary policy seems unlikely.

SNB confirmed interventions during referendum night, seeing FX reserves rising in June.

Swiss interest rates remain lower than pre-Brexit levels, and the entire gov’t curve is yielding negative rates, except the 50y. Money market rates indicate 40% probability of a 25bps cut at the next meeting 15 Sep although the Swiss central bank is likely to maintain rates status quo.

Forecast: 1.2780, and in between range 1.1.2780 - 1.2505 in next 1 to 3 months respectively.

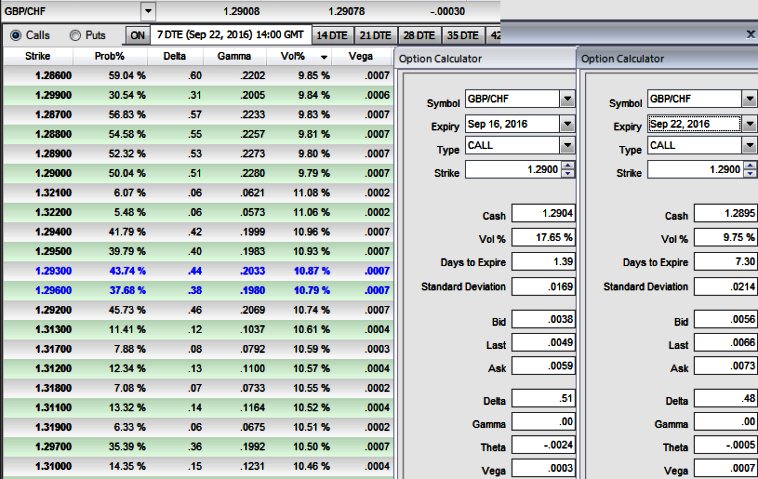

Option Trade Recommendation: Debit Call Spreads

We expect a weaker result than consensus and therefore see scope for further Sterling weakness against Swiss franc.

Execution: Go long in 2w (1%) ITM +0.67 delta call, and simultaneously short 2W (1.5%) OTM call with preferably positive theta or closer zero.

Margin: Yes, needed on short side

Rationale: The current ATM IVs are spiking at 17.21% ahead of above mentioned central bank events.

The Delta is continuously varying as the underlying spot FX fluctuates. Long options with further in-the-money (ITM) would have a higher Delta. This indicates that ITM options are worth more per pip movement in the underlying market and out-the-money options are worth less per pip.

Strategy run-through:

One can use this strategy upon the expectation of trading or even on hedging grounds that the underlying spot FX GBPCHF would rise in the long run but certainly not with drastic pace in short run. Even if it goes against, the maximum loss is limited by OTM strike price. having shorts in this strategy capitalize on reducing vols and initial premiums that we receive would finance for the long position.

Risk/Reward Profile: The profit is limited by OTM strike price, No matter how far the market moves above, the profit remains the same.

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady