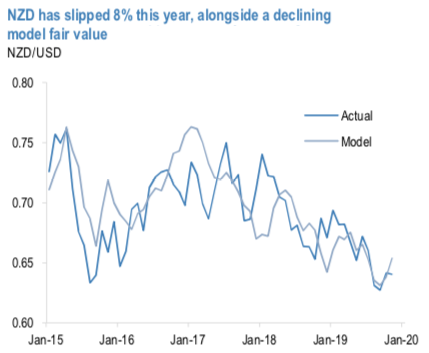

Kiwis dollar peaed upto 0.6755 levels but could not sustain, the pair has closely traced a declining fair value estimate this year, driven by falling local and global rates, weakening business confidence, and softer commodity prices (refer 1st chart). Looking into 2020, we do not expect these fundamental drivers to change much, with two more 25bp cuts forecast from the RBNZ, compared to one for the Fed, leaving rate differentials relatively bounded. NZD raced toward our year-ahead (3Q’20) forecast of 0.62 in late October, but has started to consolidate now after the November RBNZ meeting.

We see further downside risks to the OCR through 2020 because:

1) the RBNZ needs stronger growth (3%oya) than it is getting to hit its targets (refer 2nd chart);

2) it has proven its commitment to the targets. The data still matter, and the degree of shortfall relative to the central bank’s targets will influence where the cash rate settles. But for institutional and technical reasons, we view the effective lower bound as being lower in New Zealand than in Australia. RBNZ officials are also more comfortable acknowledging these scenarios than are their RBA counterparts.

NZDUSD after the pair drops below 0.6650 levels and show -0.48% losses yesterday, support at 0.6600 looks vulnerable. Potential for a near-term pullback to the 0.6500 area, followed by a resumption of the three-month old rally beyond 0.6750. We have a positive outlook for the NZ economy in 2020, while global risks are expected to persist.

OTC Updates and Hedging Strategies:

Let’s now quickly glance through OTC updates before deep diving into the strategic frameworks of NZDUSD. The pair is showing moderated IVs among G10 FX bloc (3m IVs are in between 7.20-8.15%).

IV factor is highly imperative in FX option dynamics because the option pricing significantly depends on future volatility, and it is quite impossible for any veteran to ascertain accurate future volatility.

The skewness of 3m IVs signals both upside as well as downside risks. Based on above-mentioned fundamental factors and OTC outlook, diagonal debit put spreads are advocated to mitigate the downside risks with a reduced cost of trading.

The execution: Short 2w (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options.

Alternatively, one can trade this pair with boundary options using upper strikes at 0.6640 and lower strikes at 0.6570 levels. Achieve certain yields as long as the underlying spot FX remains between these two strikes on the expiration. Courtesy: Sentry & JPM

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing

Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026

New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge