The NZD has underperformed considerably post-RBNZ monetary policy and the Trumps victory. Concerns about exports, plus a stronger US dollar, are at play.

While NZ fundamentals remain strong, the NZD will bear a risk premium linked to the threat to Asian trade volumes from the Trump win.

There is also a minor headwind (so far) from today’s earthquakes, the extent of damage likely to take some time.

On the data front, we have Q3 retail sales volume (on Tuesday), Q3 PPI and ANZ consumer confidence (on Thursday).

NZDJPY is spiking higher today at 77.444 levels, the current upswings likely to prolong upon break out above 78, failure swings to bring in an equal chance for bears, the NZD rallies against yen that is sync with the FxWirePro NZ dollar strength index flashing up with positive 51.962.

OTC updates and Options Strategy:

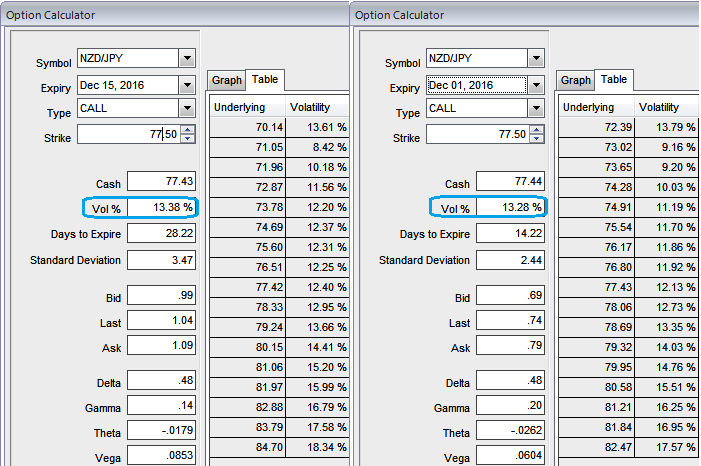

1m at the money implied volatilities of 50% delta contracts are trading at around 13.38% and 13.28% in 2w expiries which is reasonable as the vols currently are working in the interest of option holders as you can see IVs and corresponding movements in gamma.

In the Sensitivity table, Gamma of the strategy shows how much the Delta would change if the underlying rate moves by 1% on account of an extra long in OTM call.

Gamma is always a positive value, therefore you add Gamma to the value of the current Delta to estimate the new Delta in a rising market and you subtract Gamma from the current Delta to estimate the new Delta in a falling market

As a result of the above-stated economic and monetary policy events, the kiwi dollar has recently been gaining strength from last months, with NZDJPY edging up at 77.444, as all key resistance levels are likely to be broken and the further upside is possible and on the contrary long lasting major downtrend can’t be ruled out on account of the NZ central bank further easing cycle forecasts.

Well, in order to arrest this upside risk and to bet even on abrupt dips, we recommend option strap strategy that favors underlying spot’s upside bais.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 1 lot of 2W ATM 0.51 delta call, 1 lot of 1m (1%) OTM 0.36 delta call and 1 lot of ATM -0.49 delta puts of 2w tenor.

Since we anticipate upswings in near term as per the signals generated by technicals as well as from IVs and risk reversals, this NZDJPY option straps strategy should take care of both upswings and any abrupt downswings, and the strategy is likely to derive handsome returns on the upside and certain yields regardless of swings on either side as shown in the diagram.

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence